When people search for "Wagmi (Sonic) crypto exchange," they're often confused. Wagmi Protocol is a decentralized finance (DeFi) ecosystem that provides trading, liquidity provision, and leverage services-not a centralized cryptocurrency exchange platform. Let's break down what this means.

What is Wagmi Protocol?

Wagmi isn't a traditional exchange like Binance or Coinbase. It's a DeFi protocol built on blockchain technology. Think of it as a suite of financial tools that work together automatically, without a central company controlling them. The protocol evolved from Popsicle Finance, which originally focused on liquidity strategies. Now, Wagmi offers a broader range of services, including swapping tokens, providing liquidity, and even leveraged trading-all in one place.

Unlike centralized exchanges, where your funds are held by a company, Wagmi operates through smart contracts. This means users interact directly with code on the blockchain. No middleman. No account creation. Just connect your wallet and go. The protocol's official home is at wagmi.com, with active communities on Twitter and Reddit. It's important to know: "Sonic" isn't part of Wagmi's name. That term likely comes from confusion with other projects or misinformation online.

Key Features of Wagmi Protocol

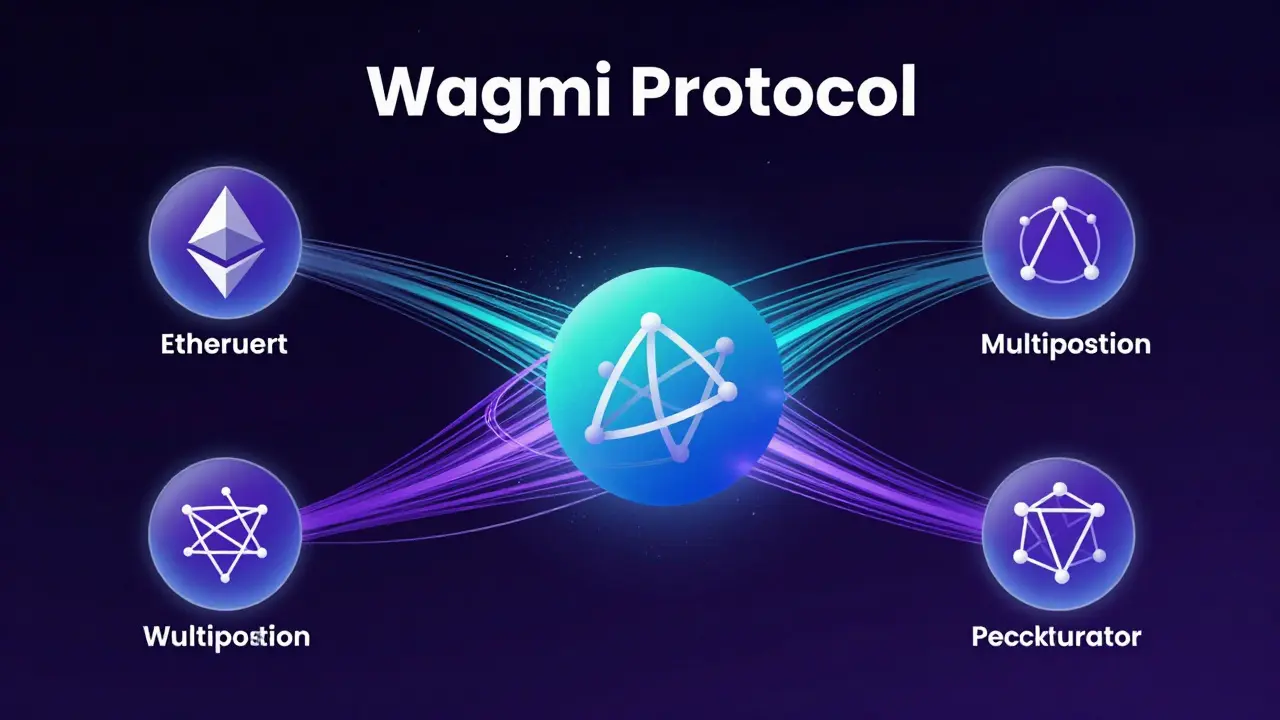

Wagmi's standout features revolve around its ability to combine multiple DeFi services. For example, it uses GMI (a multiposition concentrator that optimizes liquidity provision across multiple pools) to help users earn more from their assets. It also supports leverage trading on V3 pools (advanced liquidity pools that allow for more precise capital allocation), a feature rarely found in simple DeFi apps.

Here's what makes Wagmi unique:

- It unifies swapping, liquidity provision, and leverage in a single interface.

- Users can set up complex strategies without juggling multiple platforms.

- It's designed for multi-chain use, meaning it works across different blockchains like Ethereum and Polygon.

These features save time and reduce risks. Instead of moving funds between apps, you manage everything in one spot. But remember: this isn't a place to buy Bitcoin or Ethereum like on a stock market. It's for interacting with DeFi tools directly.

The WAGMI Token: Current Market Data

The protocol's native token, WAGMI, is a utility token that powers governance and access to services within the ecosystem. As of February 2026, it trades at approximately $0.004715. This price fluctuates based on market conditions, but recent data shows it has stayed between $0.0046 and $0.0047 for the past week.

Technical indicators paint a mixed picture. The Relative Strength Index (RSI) sits at 31.38, which is neutral-not overbought or oversold. However, 31 out of 32 technical indicators are bearish, suggesting downward pressure. Price predictions vary widely. CoinDataFlow projects a potential 95.59% gain by 2025, reaching $0.006966. Meanwhile, CoinCodex expects a range between $0.002391 and $0.003418. WalletInvestor forecasts minimum prices of $0.003665 by 2029, with averages near $0.003983.

Crucially, WAGMI isn't listed on major exchanges like Binance or Coinbase. Trading happens on decentralized platforms like Uniswap, but volume is low. This limited accessibility explains why many confuse it with a traditional exchange. You can't "buy Wagmi" like a stock; you interact with the token through DeFi tools.

Why the Confusion? DeFi vs. Exchanges

Many people mix up DeFi protocols and centralized exchanges. Why? Because both involve cryptocurrency trading. But the differences are critical. Centralized exchanges (CEXs) like Kraken or Gemini act like banks: they hold your funds, process orders, and charge fees. DeFi protocols like Wagmi are more like automated ATMs: you control your money, and smart contracts handle transactions.

Here's a quick comparison:

| Feature | Traditional Exchanges | Wagmi Protocol |

|---|---|---|

| Centralization | Centralized (company-controlled) | Decentralized (smart contracts) |

| Trading Pairs | Fixed list (e.g., BTC/USD) | Liquidity pools (e.g., ETH-USDC) |

| Order Types | Limits, market orders | Automated market makers (AMMs) |

| Security | Exchange holds funds | User-controlled wallets |

This confusion is understandable. When people hear "exchange," they imagine buying Bitcoin with a credit card. But Wagmi doesn't work that way. It's not a place to deposit dollars and trade crypto. It's a tool for experienced users who already own cryptocurrency and want to engage in DeFi activities. The "Sonic" label? That's likely a mistake. No official project uses that name.

Market Outlook and Future Plans

Current market sentiment for WAGMI is bearish, but the protocol's roadmap suggests growth. The development team plans to add limit orders and expand multi-chain support. These updates could attract more users, especially if they simplify complex DeFi strategies. However, bearish indicators persist. As of June 2025, 31 technical indicators pointed downward versus just one bullish signal.

Looking ahead, the 200-day Simple Moving Average (SMA) is projected to rise to $0.01391 by July 20, 2025, while the 50-day SMA may reach $0.006357. These numbers aren't guarantees-they reflect trends based on historical data. The real test will be adoption. If more users start using Wagmi's leverage and liquidity tools, demand for WAGMI could increase. But until then, expect volatility.

Common Misconceptions

Let's clear up a few myths:

- "Wagmi is a new exchange for beginners" → No. It's for DeFi-savvy users. If you're new to crypto, stick to centralized exchanges first.

- "You can buy WAGMI on Coinbase" → False. It's only available on decentralized platforms like Uniswap, with limited liquidity.

- "Sonic is part of Wagmi" → Incorrect. "Sonic" isn't associated with Wagmi. This may stem from a typo or confusion with unrelated projects.

Another big mistake: people think Wagmi competes with exchanges like Binance. It doesn't. Wagmi is a tool within the DeFi ecosystem, while exchanges are centralized services. They serve different purposes. Trying to use Wagmi like a traditional exchange will lead to frustration. Always verify project names and details before diving in.

Frequently Asked Questions

Is Wagmi a cryptocurrency exchange?

No. Wagmi is a decentralized finance (DeFi) protocol, not a centralized exchange. It operates through smart contracts on blockchain networks and doesn't have order books or a central authority managing trades.

Where can I trade WAGMI tokens?

WAGMI is traded on decentralized exchanges like Uniswap, but not on major platforms like Binance or Coinbase. Trading volume is low, so liquidity can be an issue. Always check the token's contract address before trading to avoid scams.

Is Wagmi safe to use?

Like all DeFi protocols, Wagmi carries risks. Smart contracts can have bugs, and market volatility is high. Always do your own research, use trusted wallets, and never invest more than you can afford to lose. Wagmi's team has audited their code, but no system is 100% secure.

What's the difference between Wagmi and Popsicle Finance?

Wagmi evolved from Popsicle Finance, which focused on liquidity strategies. Wagmi expanded this into a full DeFi ecosystem, adding leverage trading, multi-chain support, and unified tools. Popsicle is now part of Wagmi's history, not a separate project.

Can I use Wagmi without technical knowledge?

Not easily. Wagmi is designed for experienced DeFi users who understand concepts like liquidity pools, slippage, and gas fees. Beginners should start with simpler platforms before exploring complex DeFi tools.