DeFi Yield & Gas Savings Calculator

Estimate potential savings and returns using Nura Wallet's AI features based on real user data from the article:

22.3% in 30 days for Aggressive yield strategy

Nura Labs (NURA) is not just another cryptocurrency. It’s a crypto project built around a real product: an AI-powered wallet designed to automate complex DeFi tasks. Unlike most tokens that rely on speculation, NURA exists to fuel a functional ecosystem - the Nura Wallet and its AI assistant, Nura Agent. Launched in early 2025, it’s still tiny by crypto standards, but its approach could change how everyday users interact with decentralized finance.

What Exactly Is NURA?

The token’s price is extremely low - around $0.00002966 - which can be misleading. A low price doesn’t mean it’s cheap. With 10 billion tokens in circulation, even a small price increase would require massive demand to move the needle. Right now, it’s trading in a highly volatile range, with daily swings as high as 13.43%.

The Nura Wallet: Your Non-Custodial AI Assistant

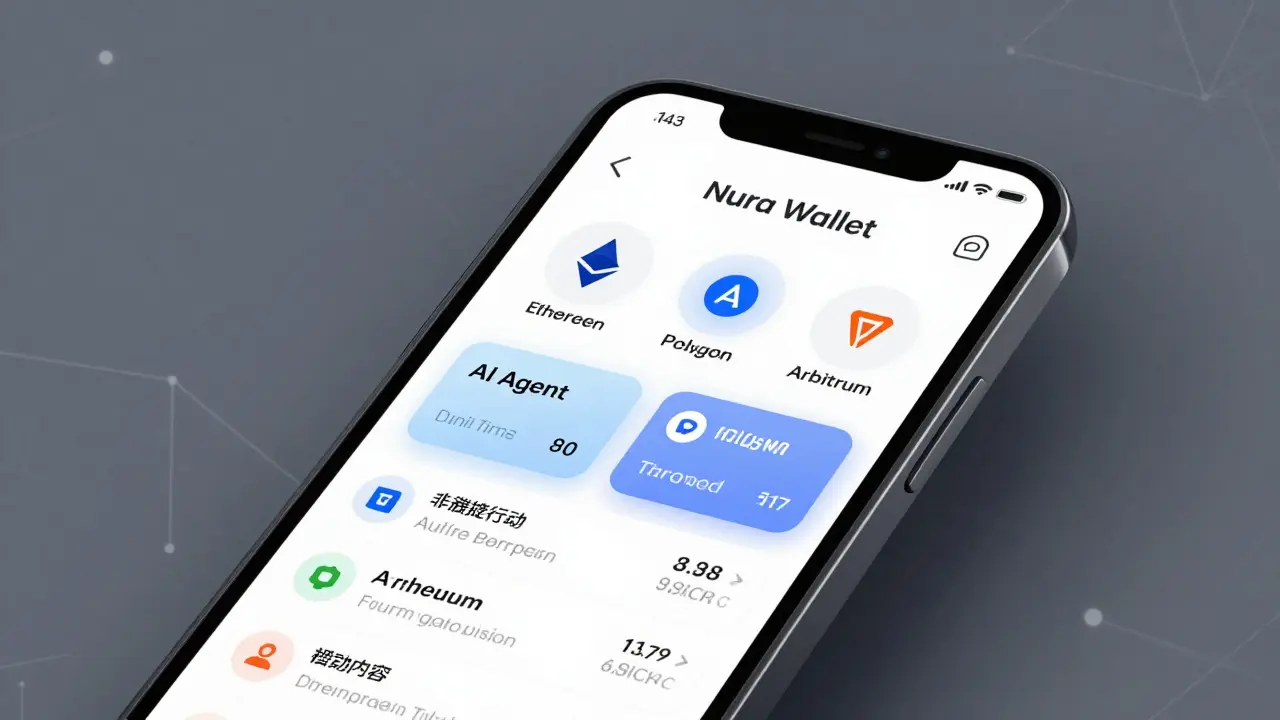

The real innovation isn’t the token - it’s the Nura Wallet. This is a mobile app you download to manage your crypto. Unlike MetaMask or Trust Wallet, Nura Wallet doesn’t just let you send and receive coins. It comes with a built-in AI assistant called Nura Agent.

Nura Agent acts like a personal DeFi trader. It watches your portfolio and automatically:

- Switches between yield farms to find the highest returns

- Executes cross-chain swaps with lower gas fees

- Rebalances assets based on risk settings you choose

- Monitors DeFi protocols for flash loan attacks or rug pulls

You don’t need to manually check Aave, Compound, or Uniswap. The AI does it for you. One Reddit user reported saving 37% on gas fees by using its automated cross-chain swaps instead of doing manual bridges. Another user earned 22.3% in 30 days using its automated yield strategy.

The wallet supports all EVM-compatible chains - Ethereum, Polygon, Arbitrum, BSC, and more. It also lets you import existing wallets and connects to WalletConnect for browser use. It’s non-custodial, meaning you control your private keys. No one else can touch your funds. But that also means if you lose your recovery phrase, your crypto is gone forever. There’s no customer support to recover it.

Nura Agent: The AI That Makes It Different

Most wallets are passive. Nura Agent is active. That’s what sets it apart. Competitors like MetaMask, Trust Wallet, and Phantom don’t have AI that makes decisions for you. They’re tools. Nura Agent is a co-pilot.

But it’s not perfect. Some users report the AI making bad calls during market crashes. One Reddit user lost 4.2% on an ETH staking position because the agent tried to re-stake during a sharp dip. The AI doesn’t always understand timing - it follows rules, not intuition.

The system learns from your preferences. If you set it to “conservative,” it avoids risky pools. If you pick “aggressive,” it jumps into high-yield but volatile protocols. You can tweak these settings, but it takes time. Nura Labs says 68% of new users need multiple tries to get the AI configured right.

Who Is Nura Labs For?

Nura Labs isn’t for beginners who just want to hold Bitcoin. It’s for people who:

- Use DeFi regularly and are tired of manual swaps

- Want to earn yield but don’t have time to monitor every protocol

- Hold assets across multiple chains and hate switching wallets

- Are comfortable with non-custodial setups and understand private keys

It’s also not for institutional investors yet. The ecosystem is too small. Only 4,200 people hold NURA tokens. Compare that to MetaMask, which has over 30 million users. Nura Labs has a 0.8% share of the AI wallet niche - far behind Taho and Rabby.

Right now, 68% of users are retail traders. The rest are small funds or DAO members testing the tech. Use cases break down like this:

- 47% - Automated yield optimization

- 33% - Cross-chain token swaps

- 20% - DApp interaction and staking

Is NURA a Good Investment?

That’s the big question. And the answer is messy.

On one side, the tech is genuinely innovative. Chainlink integrated its oracles into Nura Agent in December 2025 to improve data accuracy. That’s a big deal - Chainlink doesn’t partner with random projects. Gartner predicts AI wallets will make up 25-30% of the DeFi market by 2027. If Nura Labs executes, it could grow.

On the other side, the tokenomics raise red flags. A 10 billion supply with a $300k market cap means each token is worth pennies. That’s not inherently bad - Shiba Inu has a quadrillion supply - but it makes the token feel more like a utility token than an investment. There’s no burning mechanism. No staking rewards. No revenue share. NURA’s only job is to pay for services inside the Nura ecosystem.

Analysts are split. CoinCodex’s algorithm predicts a 24.5% price drop. The Fear & Greed Index is at 24 - “Extreme Fear.” But CryptoInsight’s Maria Chen gave it 3.2/5, calling the AI integration “the most promising DeFi tool since automated yield aggregators.”

And then there’s the risk: if Nura Labs runs out of funding, the AI agent could stop working. The wallet might keep functioning, but without updates, it’ll become outdated. The team is small. The community is quiet. There’s no guarantee this survives the next bear market.

How to Get Started

If you want to try Nura Labs, here’s how:

- Download the Nura Wallet app from the App Store or Google Play (requires iOS 14+ or Android 10+).

- Create a new wallet or import an existing one using your 12-word recovery phrase.

- Enable the Nura Agent and set your risk level (Conservative, Balanced, Aggressive).

- Deposit ETH or other EVM tokens into the wallet.

- Let the AI run. Check your portfolio weekly to see what it did.

Setup takes 8-12 minutes. First-time users often struggle with the AI settings. Don’t rush it. Watch the tutorial on their GitHub page - it scores 4.1/5 for clarity. Join their Telegram group (8,342 members) or Discord (5,721 members) if you get stuck. But don’t expect fast support - replies take an average of 14 hours.

What’s Next for Nura Labs?

The roadmap is ambitious. By Q1 2026, they plan to:

- Add support for Solana and Cosmos (non-EVM chains)

- Launch institutional-grade risk tools for hedge funds and DAOs

- Integrate with more DeFi protocols like Curve and Balancer

If they deliver, Nura Labs could become a leader in AI-driven wallets. But they’ve only just begun. Right now, they’re a risky bet - not because the tech is bad, but because they’re a small team in a crowded, fast-moving space. The token’s value depends entirely on adoption. If no one uses the wallet, NURA becomes worthless. If millions start using it, the token could surge.

Think of it like early Bitcoin - the tech mattered more than the price. Nura Labs is betting that the same will be true here. Whether that bet pays off? Only time will tell.

Is Nura Labs (NURA) a real project or a scam?

Nura Labs is a real project with a working product - the Nura Wallet and Nura Agent. The team has published technical documentation, contract addresses, and a public roadmap. It’s integrated with Chainlink, a trusted oracle provider. But it’s still very early. The low market cap, small user base, and lack of revenue model make it high-risk. It’s not a scam, but it’s not proven either.

Can I stake NURA tokens to earn rewards?

No, NURA tokens cannot be staked. The token has no built-in staking, yield, or rewards mechanism. Its only purpose is to pay for services within the Nura ecosystem, like premium AI features or priority transaction routing. Any claims of staking NURA are likely scams or misleading third-party sites.

Where can I buy NURA coin?

NURA is available on smaller exchanges like LBank and MEXC. It’s not listed on Coinbase, Binance, or Kraken. You’ll need to first buy ETH or USDT on a major exchange, then transfer it to one of these smaller platforms to trade for NURA. Be careful - low liquidity means wide spreads and high slippage.

Is Nura Wallet safe to use?

The Nura Wallet is non-custodial, which means it’s as safe as any other wallet where you control your keys. The app has been audited for basic security flaws, and its code is open on GitHub. But the AI agent introduces new risks - it can make bad trades, and if you set it to aggressive, you could lose money fast. Always test with small amounts first. Never share your recovery phrase.

Why is the NURA price so low?

The price is low because there are 10 billion tokens in circulation with very little demand. A $300k market cap divided by 10 billion tokens equals $0.00003 per token. This isn’t unusual for new crypto projects - many start this way. The real question isn’t the price, but whether adoption will grow enough to increase demand. Right now, it’s not happening at scale.

Does Nura Labs have a future?

Its future depends on two things: user growth and execution. If more people start using the Nura Wallet and the AI agent proves reliable, the project could gain traction. Partnerships like Chainlink’s show credibility. But if adoption stalls, the team may run out of funding. The tech is promising, but the crypto world is full of promising ideas that never took off.