There’s no verified information about a crypto exchange called Bitrump. No official website, no regulatory filings, no user reviews on trusted platforms like Trustpilot or Reddit, and no mention in industry reports from CoinGecko, CoinMarketCap, or CryptoSlate. That’s not normal. Legitimate exchanges-whether big like Kraken or newer ones like Bitget-have public records, security audits, and clear team profiles. Bitrump has none of that. If you’re seeing ads, social media posts, or YouTube videos pushing Bitrump as a "high-yield" or "exclusive" platform, you’re being targeted by a scam.

Why the Silence Is a Warning Sign

Legitimate crypto exchanges don’t disappear from public view. They publish their headquarters, licensing details, and compliance certifications. Kraken is registered with FinCEN and holds ISO 27001 certification. Coinbase is regulated in multiple U.S. states and publishes quarterly security reports. Even smaller exchanges like Bitstamp have clear legal teams and public audit reports from firms like CertiK or Hacken. Bitrump? Nothing. No address. No team names. No contact email that isn’t a Gmail or ProtonMail alias. That’s not "stealthy innovation." That’s how fraudsters operate. They avoid paper trails. They rely on hype, fake testimonials, and urgency: "Limited spots!" "Double your BTC in 7 days!" If it sounds too good to be true, it is-and the silence around Bitrump is the loudest red flag you’ll hear.What Legitimate Exchanges Do That Bitrump Doesn’t

Here’s what real exchanges do to protect users:- Cold storage: Over 95% of user funds are stored offline in geographically distributed vaults with armed guards and biometric access. Kraken’s vaults are monitored 24/7 with video and motion sensors.

- Multi-factor authentication (MFA): No SMS codes. They use FIDO2 Passkeys or authenticator apps like Authy. SMS is easily hijacked.

- Regulatory compliance: They register with financial authorities. In the U.S., that means FinCEN, state money transmitter licenses, and adherence to KYC/AML rules.

- Transparency: They publish proof-of-reserves regularly. This means you can verify they actually hold the crypto they claim to.

- Independent audits: Every six months, firms like Aragon or Quantstamp audit their smart contracts and security protocols.

Bitrump does none of this. If you can’t find proof of any of these things, you’re not using an exchange-you’re trusting strangers with your life savings.

The Regulatory Landscape Has Changed-And Scammers Are Falling Behind

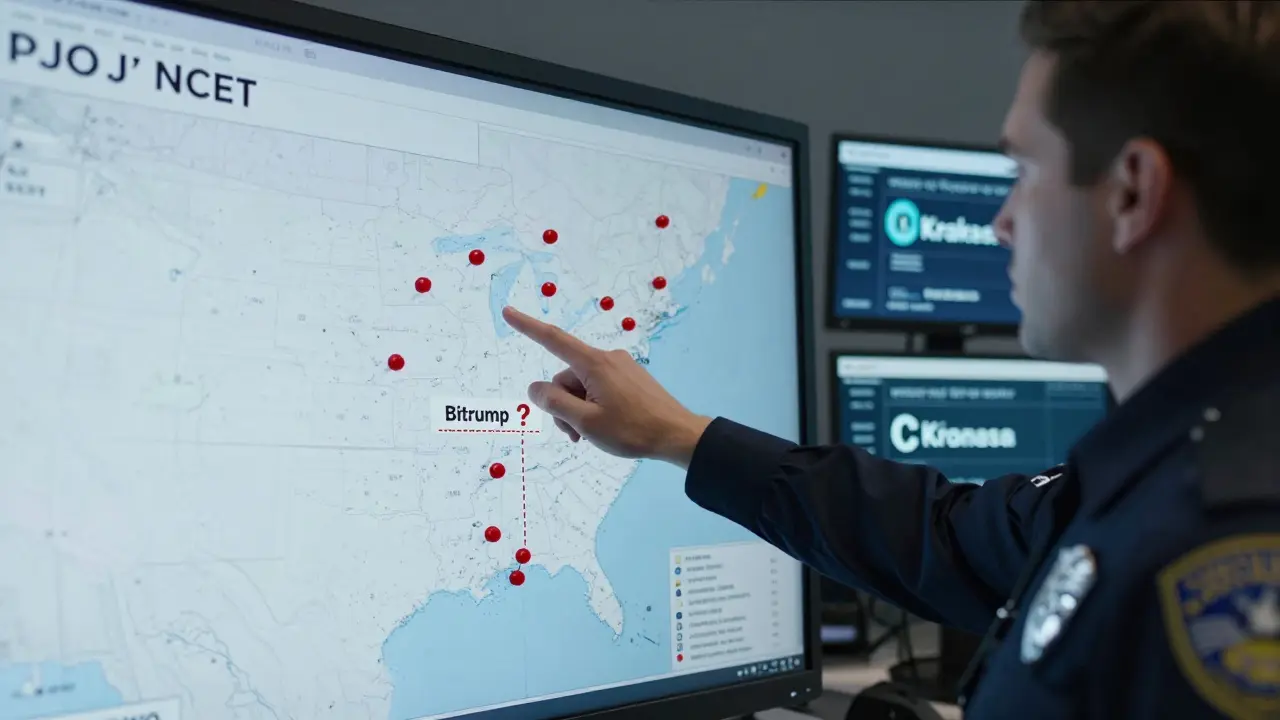

In early 2025, the SEC launched a dedicated crypto task force led by Commissioner Hester Peirce. Their goal? To create clear rules, not shut down innovation. They’ve already rescinded SAB 121 and replaced it with SAB 122, which clarifies how companies must account for crypto custody on their balance sheets. That’s a big deal. It means firms can now legally hold crypto for clients-if they follow the rules. Meanwhile, the Department of Justice’s National Cryptocurrency Enforcement Team (NCET) has charged over 40 individuals since 2021 for insider trading, market manipulation, and running fake exchanges. One case involved former Coinbase employees who stole user data to front-run trades. Another took down a fake exchange that promised 15% weekly returns. Sound familiar? Bitrump doesn’t appear on any DOJ enforcement list-not because it’s too small, but because it likely doesn’t exist. Real scammers get caught. Fake ones vanish before anyone notices.

How Retail Investors Get Burned

Most people who lose money in crypto aren’t fooled by complex hacks. They’re fooled by trust. A friend shares a link. A Telegram group says, "This is the next Bitcoin." A YouTube ad shows a smiling guy in a suit holding a laptop with a chart going straight up. Then they deposit $500, $2,000, $10,000. The platform shows fake profits. They see their balance rising. They withdraw-only to find the option is gone. Or the site crashes. Or the domain expires. And the people behind it? Gone. No trace. No refund. No recourse. Research from the University of Cambridge shows that during crypto crashes, retail investors lose 73% more than institutional holders. Why? Because institutions exit early. Retail investors hold on, hoping for a rebound. Meanwhile, the platform that promised them gains? Already drained and offline.What to Do If You’ve Already Used Bitrump

If you deposited funds into Bitrump:- Stop sending more money. Don’t fall for the "pay a fee to unlock your funds" scam. That’s how they get you again.

- Check your wallet addresses. Did you send crypto to a wallet you control? Or did you send it to an address the platform gave you? If it’s the latter, your funds are gone.

- Report it. File a complaint with the FTC at ReportFraud.ftc.gov and the IC3 (Internet Crime Complaint Center) at ic3.gov. Even if they can’t recover your money, they track patterns and shut down networks.

- Change all passwords. If you used the same password on other sites, change them now. Use a password manager.

- Enable 2FA on everything. Use an authenticator app, not SMS.

How to Find a Real Crypto Exchange

Stick to platforms with:- Clear headquarters (e.g., "Headquartered in New York, registered with the NYDFS")

- Publicly listed team members with LinkedIn profiles

- Proof-of-reserves published monthly

- Regulatory licenses visible on their website

- No promises of guaranteed returns

Examples: Kraken, Coinbase, Gemini, and Bitstamp (all U.S.-regulated). For international users: Binance (with regional compliance), Bybit (regulated in Dubai), or KuCoin (licensed in Seychelles). None of them hide behind vague names or anonymous teams.

Final Word: If It’s Not on the Radar, It’s Not Safe

Crypto is risky enough without adding fake exchanges to the mix. The market doesn’t need more Bitrumps. It needs transparency, accountability, and education. Don’t let desperation or FOMO make you ignore the basics. If you can’t verify an exchange’s existence through three independent sources, don’t deposit a cent.There are plenty of legitimate platforms out there. You don’t need to gamble on a name that doesn’t exist.

Is Bitrump a real crypto exchange?

No, Bitrump is not a real or verified crypto exchange. There are no official records, regulatory filings, security audits, or user reviews from credible sources. The absence of any verifiable information strongly suggests it is either a scam, a phishing site, or a non-operational platform designed to steal funds.

Why can’t I find Bitrump on CoinMarketCap or CoinGecko?

Legitimate exchanges are listed on CoinMarketCap and CoinGecko after meeting strict criteria: public team, regulatory compliance, trading volume verification, and security audits. Bitrump doesn’t meet any of these standards. If it were real, it would be listed. Its absence is a major red flag.

Can I get my money back if I sent crypto to Bitrump?

Recovering funds sent to a scam exchange like Bitrump is extremely unlikely. Blockchain transactions are irreversible. Once your crypto leaves your wallet and goes to an unknown address, there’s no central authority to reverse it. Your best action is to report the incident to law enforcement and secure your other accounts to prevent further losses.

What should I look for in a safe crypto exchange?

Look for: 1) Clear regulatory registration (e.g., FinCEN, NYDFS), 2) Published proof-of-reserves, 3) Use of cold storage and FIDO2 authentication, 4) Independent security audits, and 5) Transparent team information. Avoid any platform that promises high returns, uses anonymous team members, or has no verifiable contact details.

Are there any legitimate exchanges with names similar to Bitrump?

There are no known legitimate exchanges with names similar to Bitrump. Scammers often create names that sound like real platforms (e.g., Bitrump, BitRump, BitRumpExchange) to trick users into mistaking them for the real thing. Always double-check the exact spelling of the domain and verify it through official sources like the exchange’s Twitter account or press releases.