When MonoX Protocol launched on Polygon in 2021, it promised something no other decentralized exchange had done: let you provide liquidity with just one token. No more pairing ETH with USDT. No more locking up half your capital in tokens you don’t want. Just drop in your single asset, set a price, and start trading. It sounded like a game-changer.

But here’s the reality today: MonoX Protocol is practically dead. The MONO token trades at $0.0003. The 24-hour trading volume? $0. No one’s swapping. No one’s adding liquidity. The project hasn’t posted an update since 2021. And if you’re thinking about using it now, you should walk away.

What MonoX Protocol Actually Did

MonoX wasn’t trying to be another Uniswap or PancakeSwap. It wanted to fix a core problem in DeFi: capital inefficiency. On traditional DEXs, you need to deposit two tokens to create a liquidity pool. If you want to add liquidity to ETH/USDT, you have to put in $1,000 of ETH and $1,000 of USDT. That’s $2,000 locked up. Half of it might be a token you don’t believe in or can’t afford to lose.

MonoX solved that by letting you deposit only one token. The protocol used smart contracts to automatically create a synthetic pair behind the scenes. You put in MONO. The system created a MONO/USDC pool. You didn’t need USDC. You didn’t even need to think about it. The idea was brilliant on paper.

It also let anyone launch a new token without approval. Just connect your wallet, pick a starting price, and boom - your token was tradable. No governance votes. No listing fees. No waiting. That was a big deal for small projects.

Why It Failed

Brilliant idea. Terrible execution.

The biggest problem? Liquidity depth. On Uniswap, a $1 million ETH/USDT pool can handle $500,000 in trades without the price moving too much. MonoX’s single-token pools? They were shallow. Even small trades caused massive slippage. If you tried to swap $100 worth of MONO, you might get 30% less than expected. That scared off traders.

Then there was the lack of incentives. On Uniswap, liquidity providers earn trading fees. On SushiSwap, they get SUSHI tokens. MonoX had no reward system. No token emissions. No yield farming. No reason for people to stick around after the initial hype.

And the token? MONO had no utility. You couldn’t stake it. You couldn’t vote on upgrades. You couldn’t use it to pay fees. It was just a governance token that never governed anything. By 2022, even the developers stopped talking about it.

How It Compared to the Competition

In 2021, Uniswap was doing $20 billion in daily volume. PancakeSwap, on BSC, hit $2 billion. MonoX? Zero. Not $100,000. Not $10,000. $0.

Here’s how MonoX stacked up against the big players:

| Feature | MonoX Protocol | Uniswap v3 | PancakeSwap |

|---|---|---|---|

| Liquidity Model | Single-token only | Paired tokens | Paired tokens |

| Trading Volume (2021) | $0 | $20B/day | $1.8B/day |

| Token Utility | None | Fee sharing | Staking, farming |

| Token Price (2021) | $0.0003 | $10+ | $0.20+ |

| Supported Chains | Ethereum, Polygon | Ethereum | Binance Smart Chain |

| Current Status | Abandoned | Active | Active |

The numbers don’t lie. MonoX didn’t just lose. It disappeared. While Uniswap and PancakeSwap added new features, integrated NFTs, and launched mobile apps, MonoX went silent. No blog posts. No Twitter updates. No GitHub commits after 2021.

Who Was It For?

At launch, MonoX targeted two groups:

- Small token creators who wanted to launch without paying listing fees or waiting for approval.

- DeFi builders who wanted to test single-sided liquidity without risking paired tokens.

But here’s the catch: token creators didn’t care. If you’re launching a new coin, you need liquidity and visibility. MonoX offered neither. No users. No volume. No price movement. What’s the point of launching a token if no one can trade it?

And for liquidity providers? The risk was too high. Without fee incentives or impermanent loss protection, you were just gambling that the token price wouldn’t crash. And if it did? You lost everything. No safety net.

Is MonoX Safe to Use Today?

No.

Even if you find a way to access MonoX on Polygon, there’s no reason to. The smart contracts haven’t been audited since 2021. There’s no team responding to issues. No customer support. No updates. The entire ecosystem is frozen.

And if you’re thinking about buying MONO? Don’t. At $0.0003, it’s a dead asset. You can’t sell it because no one’s buying. Exchanges like SwapSpace list it only because they still have the old integration. They don’t promote it. They don’t support it.

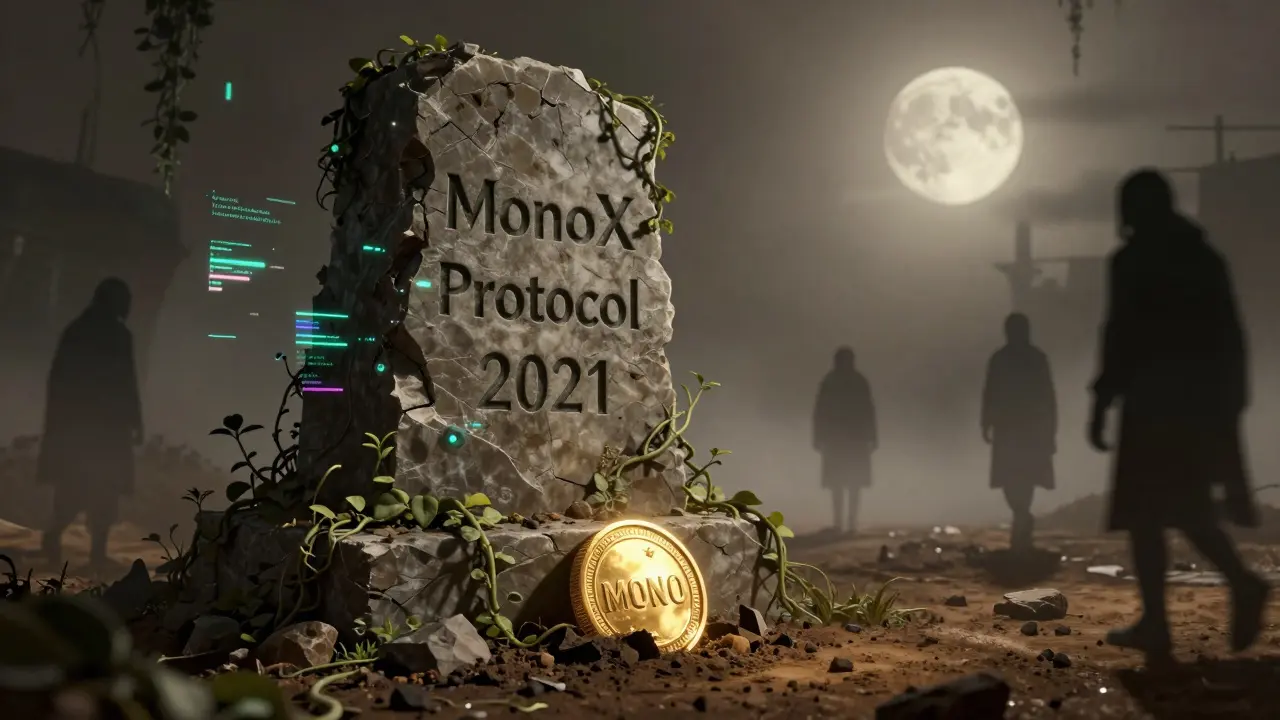

There’s no rug pull here - because there’s nothing left to pull. The project just faded out.

What Happened to the Team?

The founders were quiet even before the protocol died. Their LinkedIn profiles show they moved on to other projects by late 2022. No interviews. No follow-ups. No explanations.

They raised $5 million in 2021. That’s a lot of money. You’d think they’d have at least tried to fix the problems. But there’s no evidence they ever did. No new code. No marketing. No community engagement.

It’s possible they got distracted. Or ran out of funds. Or realized the model was flawed. Whatever the reason, they left users behind.

What You Should Do Instead

If you want single-sided liquidity, look at newer protocols that learned from MonoX’s mistakes:

- Curve Finance - Optimized for stablecoin trading with low slippage and strong incentives.

- Balancer - Lets you create custom pools with multiple tokens and weighted ratios.

- Uniswap v3 - Allows concentrated liquidity, so you can provide capital more efficiently than ever.

These platforms have volume, audits, active teams, and real user bases. They’re not perfect. But they’re alive.

And if you’re a developer? Don’t build on MonoX. Use Ethereum, Polygon, or Arbitrum with Uniswap v3 or SushiSwap. There are templates, docs, and communities ready to help.

The Bigger Lesson

MonoX didn’t fail because it was too clever. It failed because it was too simple.

DeFi isn’t just about smart contracts. It’s about incentives. It’s about community. It’s about trust. MonoX had the tech. But it didn’t have the people.

Every great protocol starts with a great idea. But only the ones that listen, adapt, and reward users survive.

MonoX had a chance. It didn’t take it.

Is MonoX Protocol still active in 2025?

No. MonoX Protocol has been inactive since 2022. There have been no updates, audits, or developer activity in over three years. The smart contracts still exist on Polygon and Ethereum, but no one is using them. The MONO token trades at $0.0003 with zero volume, indicating the project is effectively dead.

Can I still trade MONO tokens?

Technically yes, but practically no. A few obscure exchanges like SwapSpace still list MONO, but there’s no buyer interest. The 24-hour trading volume is $0. If you own MONO, you won’t be able to sell it at any meaningful price. It’s a dead asset with no liquidity.

Why did MonoX fail when it had such a good idea?

The single-token liquidity model was innovative, but it lacked real-world support. Pools were too shallow, causing high slippage. There were no incentives for liquidity providers - no fees, no token rewards. Without users and volume, the protocol collapsed. The team also disappeared after the initial launch, leaving no one to fix problems or grow the community.

Was MonoX Protocol audited?

Yes, but only once - before the mainnet launch in September 2021. No follow-up audits have been published since. Given the lack of updates and the project’s abandonment, the original audit is no longer reliable. Using MonoX today carries unknown security risks.

What are better alternatives to MonoX Protocol?

For single-sided liquidity, try Balancer or Uniswap v3, which allow concentrated liquidity with better capital efficiency. For stablecoin trading, Curve Finance is the leader. All three have active teams, regular audits, and strong user bases. Avoid any protocol with zero trading volume and no team updates.