Metal X Fee Calculator

Compare Trading Costs

Metal X Fees

Typical Ethereum Fees

Potential Savings

When you hear Metal X, you might think of a fast, reliable crypto exchange with low fees and solid security. But the truth is more complicated. Metal X isn’t just another exchange-it’s a platform that changed direction, shut down, and is now trying to come back. If you’re thinking about using it in 2025, you need to know what really happened-and where it stands today.

What Was Metal X?

Metal X started in 2020 as the trading arm of Metal Pay, a U.S.-based app that let you buy crypto with a debit or credit card. Unlike most exchanges that only handle crypto-to-crypto trades, Metal X let you go straight from dollars to Bitcoin, Ethereum, or Dogecoin. That made it useful for beginners who didn’t want to use Coinbase or Binance first.

At first, it looked promising. The interface was clean, easy to use, and had advanced tools like stop-loss orders and TradingView charts. It supported over 20 coins, including BTC, ETH, USDT, and XRP. It was also one of the few U.S.-based exchanges with a FinCEN MSB license (#31000174577713), which meant it followed federal anti-money laundering rules. That gave it credibility most DEXs didn’t have.

The Switch to Decentralized

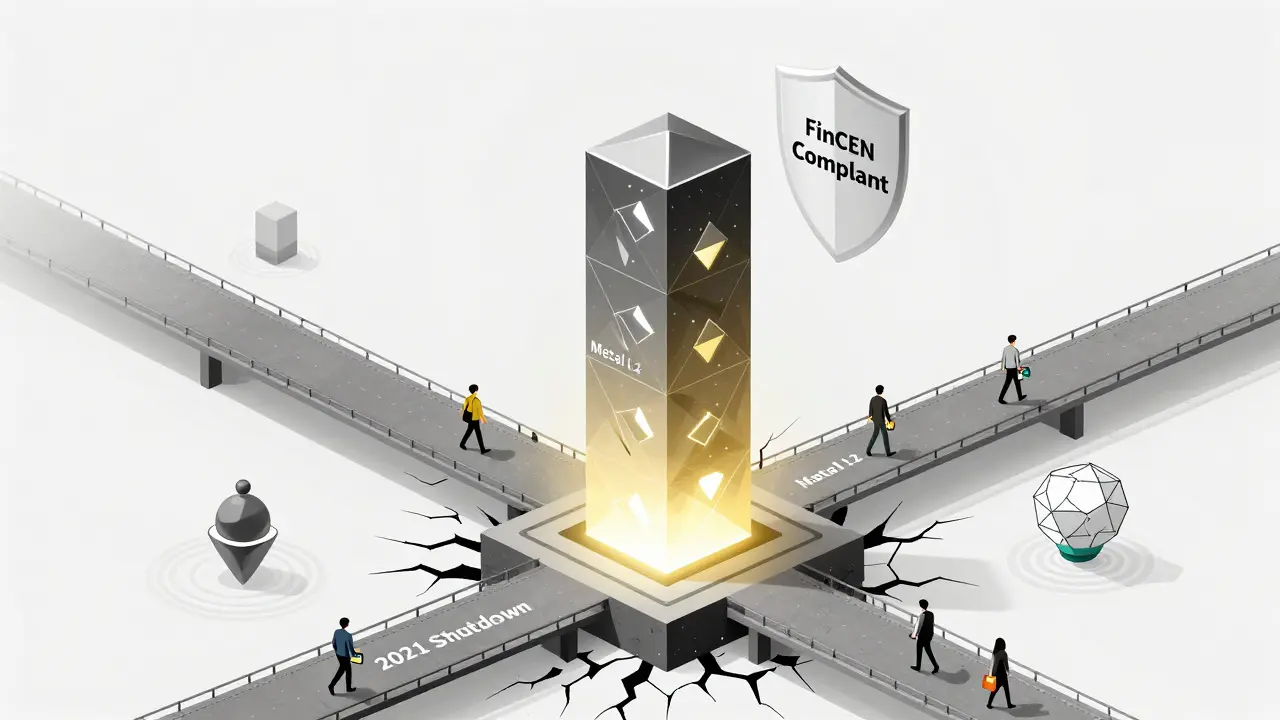

In early 2021, Metal X made a big move: it shut down its centralized exchange and shifted entirely to a decentralized model. On March 29, 2021, the platform announced it was closing its trading platform to focus on building out its core tech. Users were told their funds were safe, but many never got clear instructions on how to withdraw.

What followed was a long silence. For years, Metal X seemed gone. No updates. No customer support. No trading. Then, in 2024, things started stirring again.

By 2025, Metal X reemerged-not as a traditional exchange, but as a decentralized exchange (DEX) built on Metallicus’s own Layer 2 blockchain. This version doesn’t hold your funds. Instead, trades happen directly between wallets using smart contracts. No KYC. No middleman. Just blockchain.

That’s a big shift. If you’re used to Binance or Kraken, this will feel unfamiliar. You’ll need a wallet like MetaMask or WalletConnect. You’ll need to understand gas fees (though Metal X claims zero fees on Bitcoin trades). And you’ll need to trust code, not a company.

Fees: Are They Really Free?

One of Metal X’s biggest selling points now is its fee structure. During its centralized days, fees were confusing. Maker fees ranged from 0.05% to 0.20%, taker fees from 0.1% to 0.25%. That was higher than average. Withdrawal fees were 0.0004 BTC-slightly below the industry norm.

Now, the rules are simpler:

- 0% fees on Bitcoin trades-this is rare, even among DEXs.

- 0.2% fee for liquidity providers-if you add funds to a pool, you earn this on every trade.

- No gas fees on Metal L2-because it runs on Metallicus’s own Layer 2 chain, users don’t pay Ethereum-style network fees.

That’s a strong offer. Most DEXs like Uniswap or SushiSwap charge gas fees on Ethereum, which can hit $10-$50 per trade during busy times. Metal X’s Layer 2 removes that barrier. But here’s the catch: you can only trade tokens listed on Metal L2. If you want Solana or Polygon coins, you’re out of luck-for now.

What Can You Trade?

As of late 2025, Metal X supports around 20-25 tokens. The list includes:

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT)

- USD Coin (USDC)

- Dogecoin (DOGE)

- Metal’s native token (MTL)

- A few other Layer 2-native tokens

That’s it. No Solana, no Avalanche, no new memecoins. Compared to Binance, which lists over 1,000 coins, Metal X feels limited. But that’s intentional. Metallicus is focusing on quality over quantity. They’re not chasing hype-they’re building a stable, secure trading layer.

One advantage? You can trade across 10+ blockchains using their multi-chain bridges. So even if you hold crypto on Polygon or Arbitrum, you can swap it on Metal X without moving it manually. That’s useful if you’re already in DeFi.

Security and Compliance

Security is where Metal X still has an edge. Its centralized version had two-factor authentication (2FA), encrypted storage, and cold wallet backups. That’s gone now. The DEX version relies on blockchain security: your private keys, your responsibility.

But here’s the twist: Metal X still holds its FinCEN MSB license. Even though it’s decentralized now, Metallicus hasn’t let it expire. That’s unusual. Most DEXs operate in a legal gray zone. Metal X’s team is trying to stay compliant-possibly to prepare for future regulatory clarity.

That’s a good sign. It means they’re not just building tech-they’re building a legal framework. That could matter if regulators start cracking down on DEXs in the U.S.

Who Is Metal X For?

Metal X isn’t for everyone. Let’s break it down:

Best for:

- U.S. users who want to avoid KYC on a DEX

- Traders who want zero fees on Bitcoin

- People already using Metal Pay for card purchases

- Those comfortable with wallets and smart contracts

Not for:

- Beginners who want to click “Buy BTC” and be done

- Traders who need 500+ coins

- Anyone who expects customer support to fix a wallet mistake

- Users who need fiat withdrawals (no bank transfers anymore)

If you’re a casual buyer who just wants to hold Bitcoin, stick with Coinbase or Cash App. But if you’re into DeFi, want to avoid gas fees, and like the idea of a regulated DEX, Metal X is worth testing.

The Road Ahead: What’s Coming in 2025?

Metallicus has a clear 2025 roadmap:

- Deploy Metal X fully on Metal L2-a custom Layer 2 blockchain built for speed and low cost.

- Upgrade WebAuth 3.0 with Passkey support for easier, password-free logins.

- Add an address book so you can save wallet addresses without copying long strings.

- Improve network switching-no more manually changing chains in your wallet.

- Support more blockchains in WebAuth, so you can connect to Ethereum, Polygon, or Base easily.

These aren’t flashy features, but they’re exactly what’s missing from most DEXs. If they deliver, Metal X could become the most user-friendly DEX in the U.S.

Final Verdict: Should You Use Metal X?

Is Metal X a good exchange? It depends on what you need.

If you want a simple, fast, zero-fee way to trade Bitcoin and a few major coins without KYC, and you’re okay with a small selection of tokens-yes, try it. The platform is live, the tech works, and the team is active.

If you want to trade Solana, Shiba Inu, or 100 new altcoins, look elsewhere. Metal X isn’t trying to be Binance. It’s trying to be the most trustworthy DEX for U.S. users.

The biggest risk? History. Metal X shut down once. It took four years to come back. That’s a red flag. But the fact that they’re rebuilding with compliance, Layer 2 tech, and real user tools suggests they’ve learned from their mistakes.

For now, treat Metal X like a beta product. Not a gamble, but not a safe haven either. Use small amounts. Test it out. See if it works for your style.

And if you’re already using Metal Pay? It’s the easiest on-ramp to Metal X. Buy crypto with your card, then hop over to the DEX. That’s the real advantage here.

Frequently Asked Questions

Is Metal X still operational in 2025?

Yes, Metal X is live as a decentralized exchange (DEX) on Metallicus’s Layer 2 blockchain. It stopped its centralized trading platform in 2021, but relaunched in 2024 with a new smart contract-based system. Trading is active, and the team is releasing regular updates.

Does Metal X charge trading fees?

Metal X charges 0% fees on Bitcoin trades. For other tokens, there’s a 0.2% fee paid to liquidity providers. There are no gas fees because it runs on its own Layer 2 chain, Metal L2. This makes it cheaper than most DEXs on Ethereum.

Can I buy crypto with a credit card on Metal X?

No. The credit card buying feature is only available through Metal Pay, the parent app. Metal X is a DEX-meaning you need to deposit crypto from an external wallet. You can’t buy directly with a card on the exchange.

Is Metal X safe to use?

As a DEX, Metal X doesn’t hold your funds-you control your wallet. That’s safer than centralized exchanges if you manage your keys well. The platform has no known hacks. Its parent company, Metallicus, holds a U.S. FinCEN MSB license, which adds regulatory credibility. But always use a hardware wallet for larger amounts.

What coins can I trade on Metal X?

You can trade Bitcoin (BTC), Ethereum (ETH), Tether (USDT), USD Coin (USDC), Dogecoin (DOGE), and Metal’s native token (MTL). There are about 20-25 tokens total, all native to Metal L2. No Solana, Polygon, or newer memecoins are listed yet.

Do I need to do KYC to use Metal X?

No. As a decentralized exchange, Metal X doesn’t require KYC. You connect your wallet and trade directly. However, if you use Metal Pay to buy crypto with a card, you’ll need to verify your identity there.

What happened to my funds when Metal X shut down in 2021?

Users who had funds on the centralized exchange before March 2021 were instructed to withdraw before the shutdown. Those who didn’t may have lost access. The new DEX is a completely separate system. There is no recovery process for old centralized account balances.

Can I use Metal X outside the U.S.?

Yes, the DEX is accessible globally. However, the Metal Pay app (used for card purchases) is only available in the U.S. and a few European countries. So if you’re outside the U.S., you can still trade on Metal X, but you’ll need to bring in crypto from another exchange first.