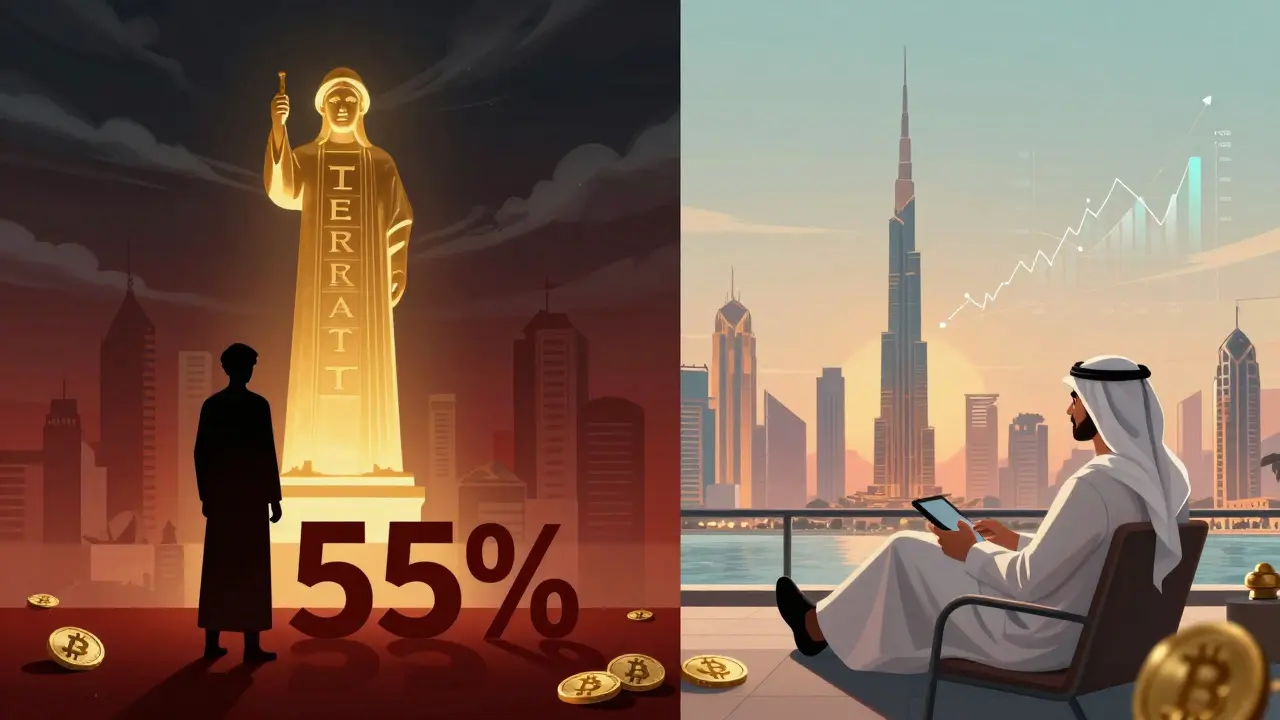

Where You Pay the Most on Crypto Gains in 2025

If you’re holding Bitcoin, Ethereum, or any other cryptocurrency, where you live could mean the difference between keeping most of your profits or handing over more than half to the government. As of 2025, crypto tax rates vary wildly across the globe - from zero to over 50%. This isn’t just about rules. It’s about real money in your pocket.

Japan leads the pack with the highest possible tax rate on crypto gains: 55%. That’s not a flat rate. It’s the top end of a progressive income tax system that kicks in for high earners. If you sell your crypto for a big profit and you’re in the highest income bracket, that’s what you’ll pay. Denmark isn’t far behind, with rates between 37% and 52%, depending on your salary. France takes a simpler but still steep approach: a flat 30% on all crypto gains, including both capital gains and social contributions. Germany is more complex - if you hold crypto for less than a year, you’re taxed at your personal income rate, which can go up to 45%. But if you wait longer? Zero tax.

Zero-Tax Countries: Where Crypto Gains Are Invisible to the Taxman

Twelve countries don’t tax cryptocurrency gains at all - not on trades, not on sales, not even on mining or staking. These aren’t tax havens hiding in the shadows. They’re active, modern economies trying to attract crypto businesses and investors.

El Salvador is the most famous example. It made Bitcoin legal tender in 2021. If you buy, sell, or hold Bitcoin there, the government doesn’t touch it. Same in the United Arab Emirates, Switzerland, and Hong Kong. Portugal used to be a top pick for crypto investors - they still don’t tax long-term holdings, but only if you’re a tax resident (183+ days per year). Panama and Malaysia also treat personal crypto investments as tax-free. The key? These countries don’t classify crypto as income unless you’re running a business.

Don’t assume zero tax means no rules. The UAE requires crypto exchanges to report transactions. Switzerland asks residents to declare holdings for wealth tax purposes, even if gains aren’t taxed. Compliance isn’t optional - it’s just less expensive.

Europe’s Patchwork of Rules

Even within the EU, there’s no unified crypto tax policy. Countries act independently, and the differences are sharp.

France taxes crypto-to-fiat sales at 30%, but crypto-to-crypto trades? Tax-free. Staking rewards and mining income? Taxed as ordinary income - up to 45%. The French tax office audits crypto users regularly and fines unreported accounts up to €750 per account. The UK uses a capital gains system: basic-rate taxpayers pay 10%, higher-rate pay 20%. You get a £3,000 annual allowance in 2025. Miss reporting? You could owe up to 200% of the unpaid tax.

Germany’s one-year rule is a game-changer. If you hold crypto for 12 months or longer, you pay nothing. That’s not a loophole - it’s policy. It encourages long-term holding over day trading. Meanwhile, the Netherlands and Spain tax crypto as ordinary income, with rates up to 49% and 47% respectively. There’s no consistency. You can’t assume EU-wide rules apply.

How the U.S. Taxes Crypto - And Why Holding Matters

The U.S. treats cryptocurrency like property. Every trade, sale, or exchange is a taxable event. But here’s the catch: how long you hold it changes everything.

If you sell crypto you’ve held less than a year, it’s short-term capital gains. That’s taxed at your regular income tax rate - between 10% and 37%, depending on your income. But if you hold it over a year? Long-term capital gains rates kick in: 0%, 15%, or 20%. For many, that’s a huge drop. A $50,000 profit held for 18 months could be taxed at 15% instead of 24%.

And it’s not just sales. If you earn crypto as a salary, through mining, staking, or airdrops - that’s ordinary income. You pay tax on its value in USD on the day you receive it. The IRS tracks this through Form 1099s from exchanges like Coinbase and Kraken. If you don’t report, you’re at risk of audits and penalties.

What Counts as a Taxable Event?

Many people think only selling crypto for cash triggers tax. That’s wrong. Here’s what actually counts:

- Selling crypto for fiat (USD, EUR, etc.)

- Trading one crypto for another (BTC for ETH)

- Using crypto to buy goods or services

- Earning crypto from mining, staking, or airdrops

- Receiving crypto as payment for work

Even swapping tokens on a decentralized exchange counts. If you bought Bitcoin for $10,000 and traded it for Ethereum worth $15,000, you just made a $5,000 taxable gain - even if you never touched cash. Most people miss this. Tax software like Koinly or CoinTracker helps track these events automatically.

Residency Rules: Where You Live Matters More Than Where You Bank

You can’t avoid tax just by moving your crypto to a zero-tax country. Tax authorities care about where you live - not where your wallet is.

Portugal only exempts crypto gains if you’re a tax resident (183+ days per year). Switzerland gives the same benefit only to residents. Non-residents? They usually pay nothing - because their gains aren’t considered locally sourced income. But if you’re a U.S. citizen? You pay U.S. taxes no matter where you live. The U.S. is one of the few countries that taxes based on citizenship, not residency.

That’s why some investors relocate - not just to save on taxes, but to simplify compliance. Moving to the UAE or Malaysia can cut your tax bill to zero. But you have to prove residency. That means renting an apartment, opening a local bank account, and staying long enough to meet the 183-day rule.

Why Compliance Is Getting Harder - And More Important

Five years ago, you could fly under the radar. Today, tax agencies have tools to track crypto like never before.

Exchanges in the U.S., UK, France, and Australia now report directly to tax authorities. Blockchain analytics firms like Chainalysis help governments trace transactions across wallets. Germany’s Federal Central Tax Office (BZSt) audits crypto users. The UK’s HMRC has launched targeted campaigns for unreported crypto gains.

Ignoring crypto taxes isn’t a smart move anymore. Penalties can be brutal: fines, back taxes, interest, and even criminal charges in extreme cases. The best defense? Keep detailed records. Track every purchase, trade, and sale. Note dates, amounts, and values in USD at the time of each transaction. Use software. Get professional help if you’re active in crypto.

What’s Next for Crypto Taxation?

More countries are coming online with clear rules. Hong Kong introduced licensing for exchanges in 2023. The EU is pushing for a unified reporting system. Even countries that once ignored crypto are now building frameworks.

But the divide is growing. On one side, nations like the UAE and Switzerland offer low or zero taxes to attract capital. On the other, the U.S., France, and Japan treat crypto like traditional investments - and tax it heavily. Your strategy depends on your goals: Are you building wealth long-term? Are you trading frequently? Are you planning to relocate?

One thing’s certain: the days of guessing your crypto tax liability are over. The rules are here. The tools exist. The audits are real. The only question left is: are you ready to play by them?

Do I have to pay tax if I never sell my crypto?

No, you don’t owe tax just for holding crypto. Tax is triggered only when you sell, trade, or spend it. But if you earn crypto through mining, staking, or airdrops, you owe income tax on its value when you receive it - even if you don’t sell it right away.

Can I avoid crypto taxes by moving to a tax-free country?

It’s possible - but only if you legally change your tax residency. You can’t just open a wallet in the UAE and call it done. Most countries require you to live there for at least 183 days a year, close bank accounts in your home country, and prove you’ve severed ties. U.S. citizens still pay U.S. taxes no matter where they live.

Is trading one crypto for another taxable?

Yes. In nearly every country, swapping Bitcoin for Ethereum counts as a taxable event. You must calculate the gain or loss based on the USD value of both coins at the time of the trade. This is one of the most overlooked tax triggers.

What happens if I don’t report my crypto gains?

Penalties vary by country. In the U.S., you could owe back taxes plus interest and a 20% accuracy-related penalty. In the UK, fines can reach 200% of unpaid tax. France imposes €750 per unreported account. In extreme cases, tax evasion can lead to criminal charges. Most tax agencies now have access to exchange data - hiding isn’t an option.

Do I pay tax on crypto losses?

You don’t pay tax on losses - but you can often use them to reduce your tax bill. In the U.S., you can offset crypto losses against gains, and even deduct up to $3,000 in net losses against other income. Similar rules exist in the UK, Germany, and Australia. Always report losses - they can save you money.