If you're trying to trade crypto on Kraken and hit a wall-whether it’s a message saying your region is blocked or you can’t trade XRP, USDT, or Monero-you’re not alone. Kraken, one of the biggest and most regulated crypto exchanges in the world, doesn’t just pick and choose where it operates. It’s forced to follow a patchwork of global laws, and that means Kraken blocked jurisdictions for crypto trading are more complex than most users realize.

Where Kraken Won’t Let You Trade

Kraken outright blocks users from 14 countries due to international sanctions. These aren’t random choices-they’re dictated by U.S. Treasury rules and global anti-money laundering standards. If you’re in Afghanistan, Belarus, Cuba, Iran, North Korea, Russia (including Crimea and occupied parts of Ukraine), Syria, Sudan, or any of the other sanctioned nations, you won’t get past the login screen. Even trying to use a VPN to bypass this will get your account frozen. Kraken doesn’t mess around. Their system flags suspicious logins, and if it detects you’re spoofing your location, you’re out.But it doesn’t stop there. There are another 15+ countries where Kraken either limits services or has pulled back entirely. Places like Lebanon, Mali, Somalia, and Yemen don’t get full access. You might be able to view your account, but you can’t deposit, trade, or withdraw. It’s not about trust-it’s about legal risk. If a country’s financial system is unstable or linked to illicit activity, Kraken cuts ties to avoid regulatory penalties.

U.S. Users Face the Most Confusing Rules

If you’re in the United States, you’re not blocked-but you’re far from free. Kraken’s U.S. operations are locked down tighter than most banks. Here’s what you can’t do:- You can’t trade XRP anywhere in the U.S.-not in California, not in Texas, not even in Wyoming.

- New York and Washington State residents can’t trade at all unless they go through a special pre-verification process that can take months.

- Residents of New Hampshire and Texas can’t hold or trade Euros on Kraken.

- US and Canadian users can’t trade EWT or GRT tokens.

- ETH2.S is only available for staking-you can’t buy or sell it directly.

- FLOW tokens are blocked for U.S., Canadian, and Japanese users.

- Margin trading is capped at 28 days for U.S. users. Outside the U.S., you can hold positions for up to a year.

Why so many rules? Because each state has its own financial regulators. New York’s BitLicense alone adds layers of compliance that force Kraken to treat the state like a separate country. And the SEC’s ongoing scrutiny means Kraken plays it ultra-safe-cutting anything that could be labeled a security, even if it’s just a token with a weird name.

Europe’s Big Stablecoin Shake-Up

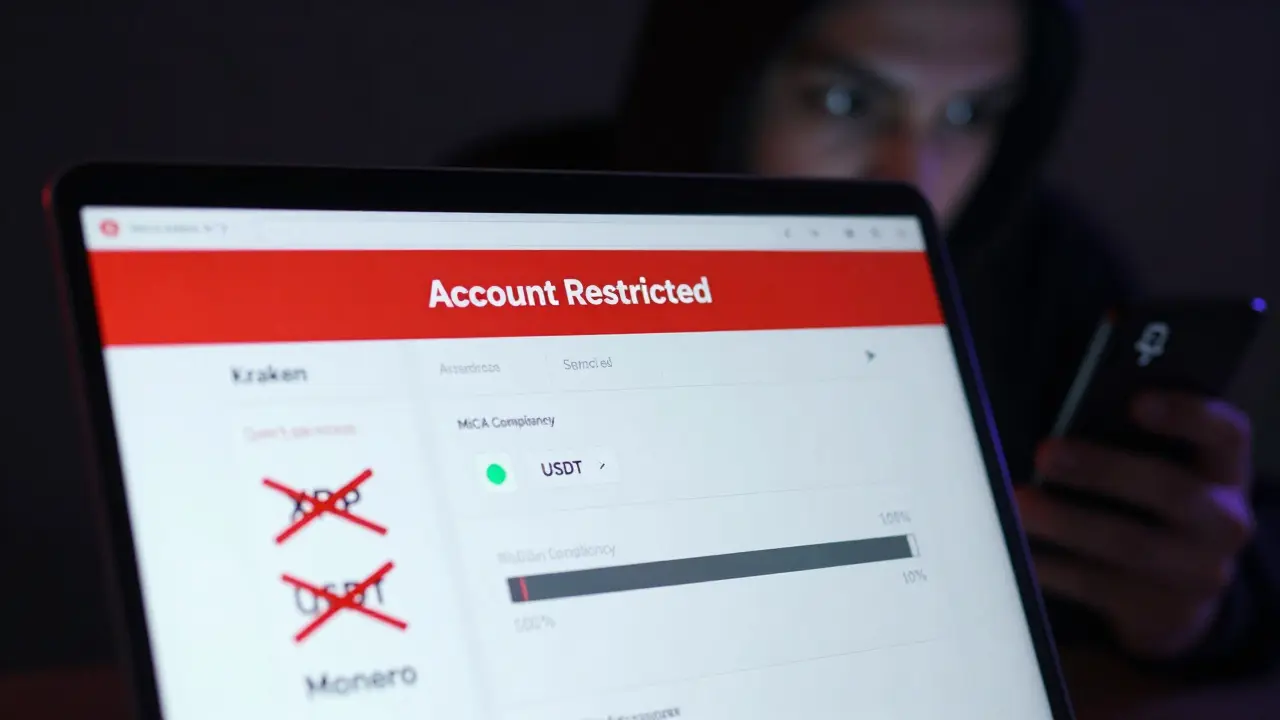

In early 2025, Kraken made a move that shocked European crypto users: it pulled five major stablecoins from the region. Tether (USDT), PayPal USD, TrueUSD, Tether EURt, and TerraClassic USD are no longer tradable on Kraken’s European platform. This wasn’t a market decision-it was a legal one.The change came because of MiCA, the European Union’s new crypto regulation. Under MiCA, stablecoins need to meet strict reserve and transparency rules. Kraken decided it was easier to drop them than to rebuild its entire compliance system for just one asset class. The timeline was brutal:

- February 13, 2025: Reduce-only mode (you could only sell, not buy)

- February 27, 2025: Sell-only mode

- March 17, 2025: Margin positions closed

- March 24, 2025: Spot trading stopped

- March 31, 2025: Final conversion to other assets

Users who held USDT were forced to convert to EUR or USD on-chain. Many complained-USDT is the most liquid stablecoin in the world. But Kraken’s legal team didn’t blink. The company had already been fined by the U.S. Treasury for past sanctions violations. They weren’t about to risk another.

Australia and Japan: Privacy Coins Are Off-Limits

If you’re in Australia, you can’t trade privacy coins at all. That means Monero (XMR), Zcash (ZEC), and Dash are completely blocked. The reason? AUSTRAC, Australia’s financial intelligence unit, requires full transaction transparency. Privacy coins violate that rule, so Kraken removed them to keep its license.In Japan, the rules are different but just as strict. You can trade crypto, but you must jump through extra hoops to use JPY. Kraken requires detailed proof of income and residence. They also limit the types of tokens you can trade based on Japan’s Financial Services Agency guidelines. It’s not that Japan is hostile to crypto-it’s just one of the most tightly regulated markets in the world.

How Kraken Knows Where You Are

Kraken doesn’t just ask you where you live. It checks you. Every time you log in, it scans your IP address. If you’re using a VPN, proxy, or Tor, it flags you. Then it asks for government-issued ID, a selfie, and proof of address-like a utility bill or bank statement. If your documents don’t match your IP, your account gets locked.They also monitor your transaction history. If you suddenly start sending funds to a wallet linked to a blocked country, they freeze your account. This isn’t paranoia-it’s compliance. Kraken has been fined $10 million by the U.S. Treasury for failing to block transactions tied to sanctioned entities. They won’t make that mistake again.

Why Kraken Blocks So Much-And Why It Matters

Some users call Kraken’s restrictions overkill. But here’s the truth: Kraken is the only major crypto exchange in the U.S. with a banking charter. It’s licensed as a Special Purpose Depository Institution in Wyoming. That’s huge. It means Kraken can hold customer funds in FDIC-insured bank accounts-something no other crypto platform can do.That license didn’t come cheap. It came with a mountain of paperwork, audits, and restrictions. Kraken had to ditch risky assets, block entire countries, and limit trading features just to stay legal. And it paid off. While other exchanges like Binance and Bybit got banned in the U.S. and Europe, Kraken stayed. That’s why institutions-hedge funds, family offices, even pension funds-trust Kraken with billions.

Yes, the restrictions are frustrating. Yes, you might wish you could trade XRP or USDT like you could on other platforms. But if you want a service that won’t vanish overnight because of a regulatory crackdown, Kraken’s rules are a feature, not a bug.

What’s Next for Kraken’s Restrictions?

Kraken is quietly working to get approval to serve users in New York and Washington State. If they succeed, it could mean full trading access for millions more Americans. They’re also exploring ways to relist stablecoins in Europe-if MiCA rules become clearer or if they can meet the new reserve requirements.But don’t expect fewer restrictions anytime soon. Around the world, regulators are tightening the screws. Canada, the UK, Singapore, and even Brazil are moving toward stricter rules. Kraken’s strategy isn’t to fight them-it’s to lead them. By being the most compliant exchange, they’re positioning themselves as the go-to platform for serious investors.

For regular users, that means more headaches. For long-term holders, it means safety. The choice isn’t about convenience-it’s about trust.

Why can’t I trade XRP on Kraken even if I’m not in the U.S.?

Kraken blocks XRP trading for all users, regardless of location, because of ongoing legal uncertainty around whether XRP is classified as a security. Even though the SEC’s lawsuit against Ripple was mostly dismissed in 2023, the regulatory gray area remains. Kraken chose to remove XRP globally to avoid any future compliance risk, even for users outside the U.S.

Can I use Kraken if I live in a blocked country but have a foreign passport?

No. Kraken verifies your residence, not your citizenship. If you live in Russia, Iran, or any other sanctioned country-even if you hold a Canadian or German passport-you won’t be allowed to trade. Kraken uses your current address, IP location, and proof of residence documents to determine eligibility. Using a foreign passport won’t bypass this.

Why did Kraken remove USDT in Europe but keep it in the U.S.?

Because U.S. regulators don’t currently classify stablecoins as securities or require the same reserve disclosures as the EU’s MiCA rules. In the U.S., USDT remains legal and widely used. In Europe, MiCA demands full transparency about backing assets, and Kraken decided it couldn’t meet those standards for USDT without major operational changes. They chose to remove it rather than risk non-compliance.

What happens if I use a VPN to access Kraken from a blocked country?

Your account will be permanently suspended, and your funds may be frozen indefinitely. Kraken’s detection systems are advanced-they track IP patterns, device fingerprints, and transaction behavior. If you’re caught using a VPN to bypass restrictions, you won’t get your money back. Kraken has publicly stated they will not reverse these actions, even upon appeal.

Are there any crypto exchanges that don’t have these restrictions?

Yes-but they come with big risks. Exchanges like Binance, Bybit, and OKX have fewer geographic blocks, but they’re not licensed in the U.S. or EU. That means no legal protection if they shut down, get hacked, or are frozen by regulators. Kraken’s restrictions exist because they’re regulated. Less restrictive exchanges often operate in legal gray zones-and that’s dangerous for your assets.