Hermes Protocol Gas Fee Calculator

Calculate how much you could save on gas fees when swapping across chains using Hermes Protocol versus traditional bridge-based swaps.

Estimated Savings

$0.00

0.0%

Note: Actual fees may vary based on network congestion. Hermes Protocol eliminates bridging fees but still requires gas on both chains for its omnichain swap.

Most crypto traders know the pain: you want to swap ETH for DAI, but your wallet is on Ethereum. Then you need to bridge to Polygon to trade DOGE for USDC. Then you bridge again to get back. Each step costs gas, time, and risk. Enter Hermes Protocol-a decentralized exchange that claims to kill the bridge entirely. No more jumping between chains. Just swap across them in one click. Sounds too good to be true? Let’s break it down.

What Makes Hermes Protocol Different?

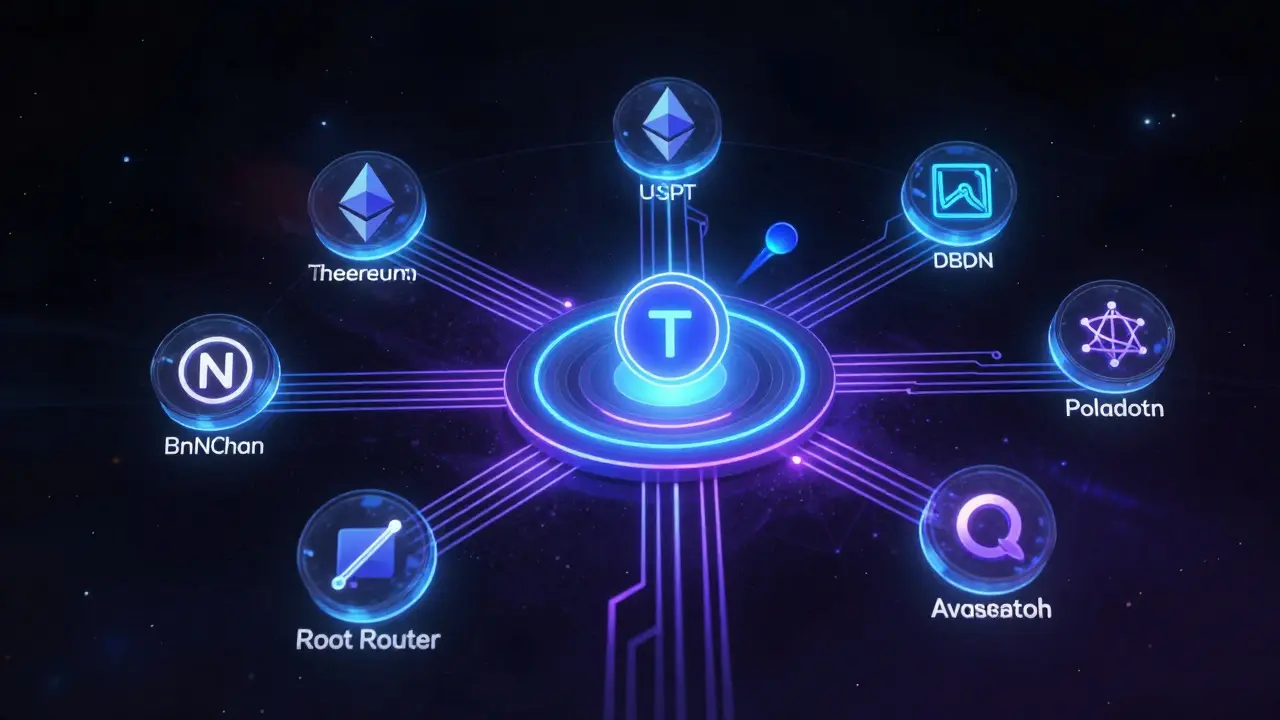

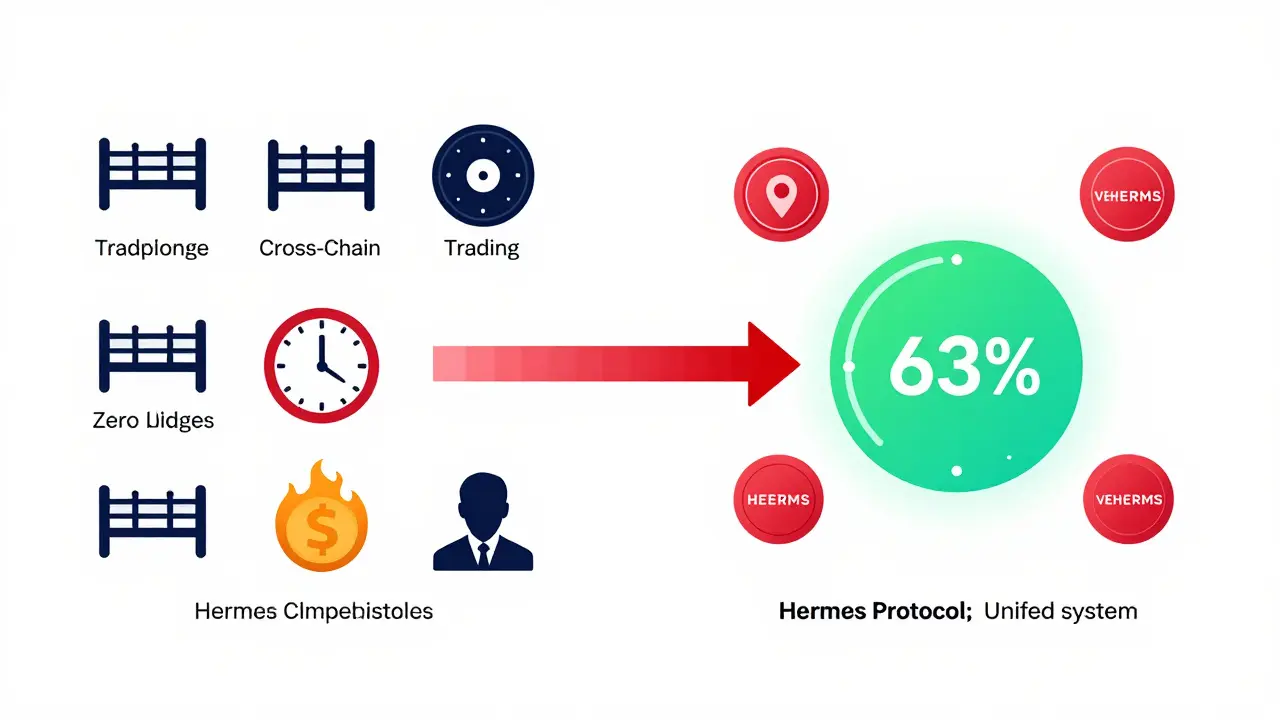

Hermes Protocol isn’t another Uniswap clone. It’s not even another Curve fork. It’s a hybrid. Built on Polkadot’s Substrate 2.0, it combines two worlds: volatile asset trading (like ETH/DOGE) and stablecoin swaps (like DAI/USDC) under one roof. Most DEXes specialize. Uniswap handles wild price swings. Curve handles stablecoins with near-zero slippage. Hermes tries to do both-and it actually works. The magic lies in its dual-pool system. For volatile pairs, it uses the classic x*y=k model. For stablecoins, it uses a custom algorithm that keeps prices locked within pennies. The result? Stablecoin trades on Hermes have 87% less slippage than on standard AMMs. That’s not marketing fluff-it’s backed by internal benchmarks from Blocmates’ December 2023 analysis. But the real game-changer is the omnichain architecture. Instead of relying on third-party bridges like Wormhole or LayerZero, Hermes uses a Root Router system. Think of it like a central highway with dedicated on-ramps (ports) for each blockchain: Ethereum, Polygon, BNB Chain, Polkadot, and Avalanche. When you swap DOT for USDT, the transaction doesn’t go through a bridge. It gets routed directly through Hermes’ unified liquidity pool. Settlement time? Up to 63% faster than traditional cross-chain swaps.How It Works (Without the Confusion)

Using Hermes isn’t plug-and-play, but it’s not rocket science either. Here’s the real flow:- Connect your wallet-MetaMask for Ethereum-based chains, Polkadot.js for Polkadot-native assets.

- Select your source chain (e.g., Ethereum) and destination chain (e.g., Polygon).

- Pick your pair: ETH/DAI (volatile) or DAI/USDC (stable).

- Confirm the swap. Hermes auto-figures out the route through its Root Router.

- Wait 15-45 seconds. Done.

Tokenomics: The HERMES Token and veHERMES

HERMES is the native token. Total supply: 100 million. Circulating supply: ~227 million? That’s not a typo. The protocol minted extra tokens during early liquidity incentives. As of December 5, 2025, the price hovers around $0.0015-$0.0019. Market cap? Around $430K. That’s tiny compared to Uniswap’s $1.2B market cap. But here’s the twist: HERMES isn’t just a trading token. It’s the backbone of governance. To vote on protocol changes or earn trading fee rewards, you need to lock HERMES into veHERMES NFTs. Lock 10,000 HERMES for four years? You get voting power and a share of protocol revenue. Protocols that list trading pairs on Hermes get 1% of the initial veHERMES supply as an incentive-meaning if a new DeFi app wants to offer ETH/DAI on Hermes, they have to lock up HERMES tokens to pay for it. It’s a clever way to bootstrap liquidity. But it also means most HERMES holders are retail traders. Etherscan data shows 78% of token holders own less than 10,000 HERMES. No whales. No institutions. Just people betting on the ecosystem.

Liquidity: The Elephant in the Room

Let’s be honest: Hermes Protocol has almost no liquidity compared to the giants. - Uniswap TVL: $3.2 billion - Curve TVL: $2.8 billion - Hermes Protocol TVL: $440,690 (as of November 2023) That’s 0.0008% of the total DEX market. For small trades-$500 or less-it’s fine. Reddit user ‘DeFi_Trader88’ reported a $500 DOT-to-ETH swap with only 0.15% slippage. But try to move $10K? You’ll get crushed by slippage. The 24-hour trading volume on Coinbase was $1.61K. On CoinGecko? $538. That’s not a thriving exchange. That’s a testnet with real money. Messari called it the “chicken-and-egg problem.” No liquidity because no traders. No traders because no liquidity. Hermes needs to break that cycle. Their solution? Liquidity mining. In December 2023, the Maia DAO voted to allocate 15% of protocol fees-roughly $6,500 per month-to reward users who add liquidity to stablecoin pairs. Their goal? Grow TVL from $440K to $2M by Q3 2024. That’s ambitious. Possible? Only if more chains join and users trust the system.Security and Audit Status

CertiK audited Hermes Protocol’s smart contracts in November 2022 and gave it a 7.8/10 safety score. Three medium-severity issues were found-mostly around slippage handling during cross-chain swaps. All were patched in the V2 upgrade. That’s a good sign. No critical vulnerabilities. No rug pulls. No exploits. But audits don’t guarantee safety in DeFi. The real risk is in the architecture itself. Alex Svanevik of Nansen called the bridgeless omnichain model “technically elegant but potentially fragile under extreme market volatility.” What happens if Ethereum gas spikes and the Root Router can’t process swaps fast enough? Users report failed transactions during those spikes. The fix? Manually bump gas limits to 1.5x the recommended value. That’s not user-friendly. It’s a workaround. The Reputation Committee-a group of verified nodes that monitor for bad actors-adds another layer of trust. But it’s centralized. And in DeFi, centralization is a red flag.

Who Is This For?

Hermes Protocol isn’t for everyone. It’s not for: - Institutional traders (too little liquidity) - People who want instant support (customer response takes 72 hours on average) - Beginners who hate reading docs (the interface is clunky) It is for: - Polkadot ecosystem users who trade across chains daily - Retail traders who want to avoid bridge fees and delays - DeFi enthusiasts who believe in cross-chain unification - People willing to experiment on the bleeding edge If you’re already using DOT, ETH, or POLY regularly and swap between them, Hermes could save you time and gas. If you’re just holding BTC and want to trade USDT? Stick with Coinbase or Kraken.The Competition

Hermes doesn’t compete with Binance. It competes with: - Uniswap V3 - Better liquidity, worse cross-chain - Curve Finance - Better stablecoin swaps, no volatile assets - ThorChain - Cross-chain, but slower, more complex - Orbiter Finance - Bridges, not unified pools Hermes is the only one that combines stable + volatile + omnichain in one place. That’s its edge. But it’s also its weakness. No one else is trying this exact model. That means no playbook. No proven success. Just a bold experiment.Final Verdict: Niche, But Promising

Hermes Protocol isn’t the next Uniswap. It won’t hit $1B TVL next year. But it’s one of the few DeFi projects actually solving a real problem: cross-chain fragmentation. It’s not perfect. Liquidity is thin. The UI is rough. Support is slow. But the tech? It works. If you’re deep in the Polkadot ecosystem, or you trade across multiple chains regularly, Hermes is worth testing. Start small-$100. See how it feels. If you get a clean swap with 0.1% slippage and no bridge fees? You’ve found a tool that could save you hundreds in gas over time. If you’re just looking for the safest, easiest place to trade crypto? Walk away. This isn’t for you.Right now, Hermes is a prototype with real money. It’s not a product. It’s a proof of concept. And if it succeeds, it could change how we think about decentralized exchanges. If it fails? At least you tried something new.

Is Hermes Protocol safe to use?

Yes, but with caveats. CertiK audited the smart contracts and gave it a 7.8/10 safety score. All known vulnerabilities were patched in the V2 upgrade. There have been no exploits or hacks. However, the system relies on a Reputation Committee and a complex omnichain architecture, which introduces new failure points during network congestion. Always start with small amounts and never deposit more than you’re willing to lose.

Can I trade BTC on Hermes Protocol?

Not directly. Hermes Protocol currently supports Ethereum, Polygon, BNB Chain, Polkadot, and Avalanche. Bitcoin isn’t natively supported. You’d need to wrap BTC into WBTC on Ethereum or another chain first, then swap it on Hermes. There are no plans to add native Bitcoin support as of December 2023.

How do I get HERMES tokens?

You can buy HERMES on decentralized exchanges that list it, such as Hermes Protocol’s own interface or smaller DEXes on Polkadot and Ethereum. It’s not listed on major centralized exchanges like Coinbase or Binance. You’ll need a wallet like MetaMask or Polkadot.js to connect and trade. Be cautious of fake tokens-always verify the contract address on the official Hermes Protocol website.

What’s the difference between HERMES and veHERMES?

HERMES is the native token you trade and hold. veHERMES is a locked, non-transferable NFT you create by locking HERMES tokens for a set period (up to 4 years). veHERMES gives you voting rights in the Maia DAO and a share of protocol fees. You can’t sell or transfer veHERMES-it’s purely for governance and rewards.

Why is the trading volume so low?

Because liquidity is still small. Hermes Protocol launched with minimal funding and no big institutional backing. Most traders stick to Uniswap or Curve because they have deeper pools and better prices. Hermes is trying to fix that with liquidity mining rewards, but it’s a slow process. Low volume means higher slippage on larger trades-so it’s only practical for retail-sized swaps under $1,000.

Is Hermes Protocol only for Polkadot users?

No. While it’s built on Polkadot’s Substrate 2.0, Hermes Protocol connects to Ethereum, BNB Chain, Polygon, and Avalanche too. You can use it with MetaMask if you’re on Ethereum. You don’t need DOT or a Polkadot wallet to trade on it-just a compatible wallet and some gas on the chain you’re swapping from.

Will Hermes Protocol survive in 2025?

It’s uncertain. Galaxy Digital estimates a 68% chance of survival based on treasury reserves and ecosystem support. JPMorgan’s team gave it only a 40% chance, citing lack of liquidity and competition. Its fate is tied to Polkadot’s growth. If Polkadot gains traction in 2024-2025, Hermes could ride that wave. If not, it may fade into obscurity. The V2 upgrade was a strong step-but it’s only the beginning.