Most crypto users know the big names: Uniswap, SushiSwap, PancakeSwap. But if you're digging into Polygon-based DeFi, you might have stumbled across Firebird Finance. It’s not the biggest player. It doesn’t have the brand recognition. But if you care about maximizing yield without paying $50 in gas fees every time you swap, it’s worth a closer look.

What Exactly Is Firebird Finance?

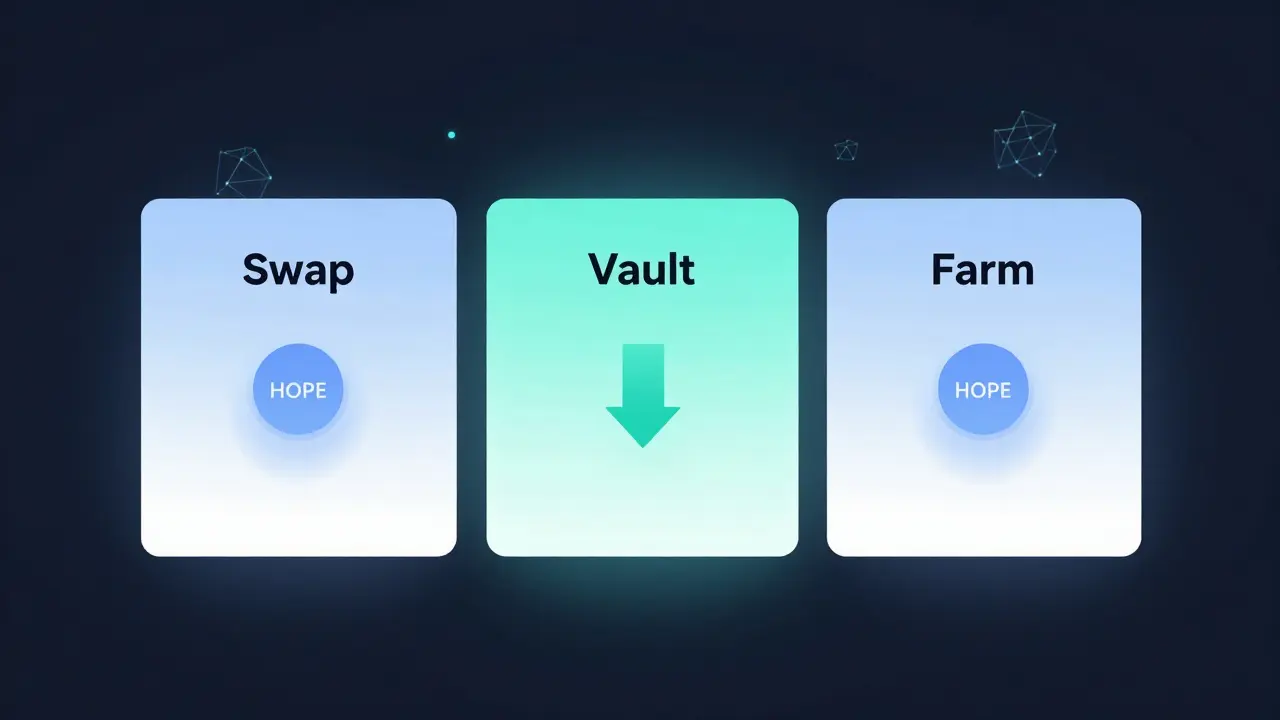

Firebird Finance isn’t just another decentralized exchange. It’s a three-in-one DeFi toolkit built on Polygon and Binance Smart Chain. Think of it as a hybrid: part swap platform, part yield aggregator, and part vault system-all rolled into one interface. You don’t need to jump between five different apps to farm, stake, and trade. Firebird does it all in one place.Its core swap engine works like any AMM (Automated Market Maker). You trade tokens directly from your wallet. But here’s the twist: every trade you make can also earn you rewards. That’s because liquidity providers get paid in HOPE, Firebird’s native token, and the platform auto-compounds your earnings in its vaults. No manual claiming. No missed compounding cycles. It just happens.

The Three Pillars: Swap, Vault, Farm

Firebird’s structure is simple but powerful. It breaks down into three main functions:- Swap: Trade tokens with low slippage. The platform supports major assets like USDC, USDT, DAI, MATIC, and even lesser-known Polygon tokens. Its OneSwap feature is optimized for stablecoin swaps-ideal if you’re moving between stable assets without losing value to price drift.

- Vault: Deposit your LP tokens or single assets into a vault, and Firebird automatically reinvests your rewards. Think of it like a savings account that compounds daily, but for crypto. The vaults are designed to maximize APY without you lifting a finger.

- Farm: Stake your tokens in liquidity pools to earn HOPE. These aren’t just basic farms. Firebird’s farms-as-a-service lets any project launch their own yield program on the platform in minutes. That means you’re not just farming Firebird’s own pools-you’re also accessing new, experimental farms from smaller projects before they hit bigger exchanges.

This integration is rare. Most DeFi platforms make you bounce between a DEX, a staking site, and a yield optimizer. Firebird ties them together. That’s a big deal if you’re active in DeFi and tired of managing 10 different tabs.

HOPE Token: The Engine Behind the System

HOPE is Firebird’s governance and reward token. It’s not listed on major centralized exchanges like Binance or Coinbase. You can only get it by farming, staking, or swapping on Firebird’s platform. As of early 2026, HOPE has limited liquidity, and trading volume is low. CoinCodex doesn’t even generate price predictions for it yet-because there’s not enough historical data.That’s not necessarily bad. It means HOPE isn’t being pumped by speculators. But it also means you’re taking a bet on the platform’s future. If Firebird grows, HOPE could gain value. If it stalls, your rewards might be worth less over time. The locked staking option gives you higher yields in exchange for locking your HOPE for 30, 60, or 90 days. It’s a trade-off: lower liquidity for higher returns.

How It Stacks Up Against the Competition

On Polygon, Firebird Finance competes with giants like SushiSwap, which has over $5 billion in TVL. Firebird’s TVL? Around $4.79 million. That’s less than 0.1% of SushiSwap’s. So why even consider it?Because size isn’t everything. SushiSwap is a general-purpose DEX. Firebird is a precision tool. If you want to trade ETH for USDC and call it a day, go to SushiSwap. But if you want to trade USDC for DAI, stake the LP tokens in a vault, auto-compound for 30 days, then harvest HOPE rewards-all without leaving the platform-Firebird wins.

Also, Firebird’s farms-as-a-service is unique. It lets DeFi projects launch their own yield programs without building infrastructure from scratch. That means you’re getting early access to new token farms before they’re listed elsewhere. For active yield farmers, that’s a real edge.

Who Is This For? (And Who Should Skip It)

Firebird Finance isn’t for beginners. You need to understand:- What liquidity pools are

- How impermanent loss works

- How to bridge assets from Ethereum to Polygon

- How to connect a wallet like MetaMask to a DEX

If you’re still learning these basics, stick with centralized exchanges or simpler DeFi apps like Aave or Compound. Firebird assumes you already know how to navigate DeFi.

But if you’re an active DeFi user who farms daily, checks APYs religiously, and hates manual compounding? Firebird could save you hours a week. The auto-vaults alone cut down on gas fees and time spent managing rewards.

Pros and Cons at a Glance

| Pros | Cons |

|---|---|

| Integrated swap, vault, and farm in one interface | Very low TVL ($4.79M) compared to competitors |

| OneSwap reduces slippage on stablecoin trades | HOPE token has low liquidity and no CEX listings |

| Auto-compounding vaults save time and gas | Limited documentation and user support |

| Farms-as-a-service unlocks early access to new projects | No mobile app-only web interface |

| Low gas fees thanks to Polygon | Limited community feedback or reviews available |

Real-World Use Case: A Day in the Life

Imagine you’re a DeFi farmer. You start with $2,000 in USDC. You use Firebird to swap half into DAI, then add both to the USDC-DAI liquidity pool. You stake that LP token in Firebird’s vault. Overnight, the vault auto-compounds your rewards. You earn HOPE tokens from the farm. You lock half your HOPE for 60 days to boost your APY. The next day, you see a new farm launched by a small DeFi project-built using Firebird’s farms-as-a-service. You jump in with $500. No code. No smart contract audits you need to read. Just click and stake.That’s the Firebird experience. It’s not flashy. It doesn’t have celebrity endorsements. But it removes friction. And in DeFi, removing friction means more earnings over time.

The Bigger Picture: Why Polygon Matters

Firebird’s success is tied to Polygon. Polygon solves Ethereum’s biggest problems: slow transactions and high fees. On Polygon, a swap costs less than $0.10. Confirmations take 2-3 seconds. That’s why DeFi thrives here. Firebird leverages that. It’s not trying to compete with Ethereum-based DEXs. It’s thriving in the space Ethereum can’t serve well-high-frequency, low-cost DeFi.That’s also why Firebird’s niche makes sense. Mainstream users don’t care about yield farming. But for those who do, Firebird offers a streamlined, no-nonsense platform. It doesn’t try to be everything to everyone. It’s built for a specific group: active yield farmers who want efficiency.

Final Verdict: Worth Your Time?

If you’re looking for the biggest, most popular DEX on Polygon? Firebird Finance isn’t it. But if you want a platform that does one thing exceptionally well-help you farm, stake, and compound with minimal effort-it’s one of the best options out there.The lack of reviews and low TVL are red flags if you’re risk-averse. But if you’re comfortable with mid-tier DeFi projects and want to optimize your yield without jumping between apps? Firebird Finance delivers. It’s not a get-rich-quick scheme. It’s a productivity tool for DeFi traders who treat yield farming like a job.

Try it with a small amount first. Test the swap, deposit into a vault, see how the rewards flow. If it feels smooth and you understand what you’re doing, then scale up. If it feels overwhelming? Walk away. There’s no shame in sticking to simpler tools.

Firebird Finance doesn’t need millions of users to be valuable. It just needs the right ones.

Is Firebird Finance safe to use?

Firebird Finance is a non-custodial platform, meaning you control your own keys and funds. There’s no central authority holding your assets. However, like all DeFi platforms, it relies on smart contracts. While the code hasn’t been publicly audited in widely known reports, the platform operates on Polygon, which is a battle-tested layer-2 network. Always start with a small deposit, never invest more than you can afford to lose, and double-check contract addresses before interacting.

Can I use Firebird Finance on my phone?

No, Firebird Finance doesn’t have a dedicated mobile app. You must use a desktop browser with a wallet like MetaMask connected. Some users access it via mobile browsers, but the interface isn’t optimized for small screens. For best results, use a laptop or desktop.

How do I get HOPE tokens?

You can earn HOPE by providing liquidity to Firebird’s farming pools or by staking in its vaults. You can’t buy HOPE on Coinbase, Binance, or any centralized exchange. It’s only available through Firebird’s own platform. Once you earn it, you can hold it, lock it for higher rewards, or trade it for other tokens on Firebird’s swap page.

What’s the difference between Firebird and SushiSwap on Polygon?

SushiSwap is a general-purpose DEX with massive liquidity and a wide range of token pairs. Firebird is smaller but focused: it combines swapping, vaults, and yield farming into one streamlined system. SushiSwap doesn’t have auto-compounding vaults or farms-as-a-service. Firebird trades volume for specialization. If you want to farm efficiently, Firebird wins. If you want to trade rare tokens, SushiSwap has more options.

Do I need to bridge my assets to use Firebird?

Yes. Firebird runs on Polygon, so you need to move your assets from Ethereum mainnet to Polygon first. You can do this using Polygon’s official bridge or through wallet integrations like MetaMask’s built-in bridge. Never send ETH or ERC-20 tokens directly to a Polygon address-your funds will be lost.

Is there customer support for Firebird Finance?

There’s no official customer service team or live chat. Support is limited to community channels like Discord or Telegram, if they exist. Documentation is minimal. You’re expected to understand DeFi basics before using the platform. If you need hand-holding, this isn’t the right platform for you.

Can I lose money using Firebird Finance?

Yes. You can lose money through impermanent loss when providing liquidity, especially if token prices swing wildly. You can also lose funds if you interact with a fake contract or send assets to the wrong address. Always verify URLs (firebird.finance), never click random links, and test with small amounts first. DeFi is not FDIC-insured.