Firebird Finance Cashback Calculator

Firebird Finance offers 0.1%-0.5% FBA token cashback on every swap. Calculate your potential earnings below.

Your Estimated Cashback

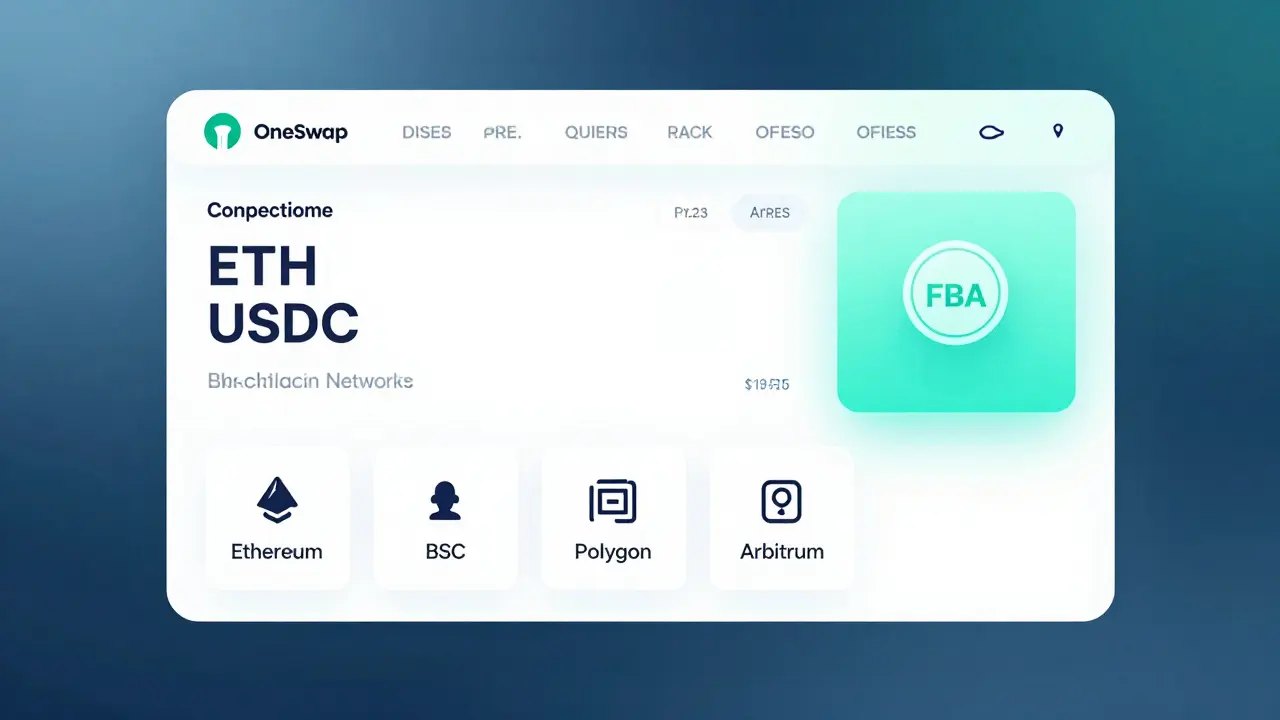

Most crypto traders know the frustration: you want to swap ETH for USDC, but the rate on Uniswap is 0.5% worse than on Curve. You switch platforms, pay another gas fee, and still don’t get the best deal. Now imagine getting the best rate automatically-plus cashback-without juggling ten different wallets or DEXs. That’s the promise of Firebird Finance is a multi-chain decentralized exchange (DEX) aggregator that pulls liquidity from over 140 decentralized exchanges across Ethereum, BSC, Polygon, Arbitrum, and more. Also known as Firebird DeFi, it’s designed to simplify swapping, farming, and earning in DeFi with one interface.

How Firebird Finance Works: Swap Smarter, Not Harder

Firebird Finance doesn’t hold your funds or act as a custodian. Instead, it’s a smart router. When you click ‘Swap’, its algorithm scans 140+ DEXs-including Uniswap, Curve, Balancer, WOOfi, and BeethovenX-to find the cheapest, fastest path for your trade. It checks slippage, gas costs, and liquidity depth across chains to deliver the best possible rate. You don’t need to open 10 tabs or remember which DEX has the deepest pool for WETH/USDT. Firebird does it for you.

Its flagship tool, OneSwap, handles all swaps under one roof. The interface is clean, with simple input/output fields and real-time rate comparisons. Even if you’re new to DeFi, you can complete a swap in under five minutes. No complex slippage settings. No need to understand liquidity pools. Just pick your tokens, confirm, and go.

The Two Tokens: FBA and HOPE-What They Actually Do

Firebird Finance runs on two native tokens, but they serve very different purposes.

FBA is the utility token. Every time you swap on Firebird, you earn FBA as cashback-typically 0.1% to 0.5% of your trade value, depending on volume and token pair. It’s like getting a rebate on every crypto trade. You can hold it, stake it, or trade it on supported DEXs. FBA has real trading volume and is listed on several decentralized exchanges.

HOPE is the governance token. You can’t buy it directly on any exchange. Instead, you earn it by locking FBA or participating in platform activities. But here’s the catch: as of December 2025, HOPE shows $0 price and $0 trading volume on CoinMarketCap. Total supply and circulating supply are both listed as zero. That means no one is trading it. No one is using it.

HOPE’s design is clever on paper: lock HOPE for 1 week to 4 years to get mHOPE. mHOPE gives you voting rights and a share of trading fees from OneSwap. But if no one holds HOPE, no one gets fees. And if no one gets fees, why lock tokens? The system is stuck in a loop. It’s like a loyalty card that gives you points-but no store accepts them.

Yield Farming, Vaults, and Farms-as-a-Service

Firebird doesn’t stop at swaps. It offers three other DeFi tools:

- Vaults: Deposit stablecoins or tokens into automated strategies that compound your yield. One vault might auto-swap USDC into ETH when prices dip, then back again when they rise.

- Farms-as-a-Service: You pick a farming pair (like USDT/ETH), and Firebird handles the rest-staking, harvesting rewards, reinvesting. No manual claiming. No need to jump between chains.

- Referral Program: Invite others, earn 10% of their swap cashback. Simple, effective, and scalable.

These features make Firebird more than a swap tool-it’s a full DeFi dashboard. But remember: yield farming carries risk. Smart contract bugs, impermanent loss, and chain congestion can eat into returns. Firebird doesn’t guarantee profits. It just makes it easier to try.

How Firebird Compares to 1inch, Kyber, and ParaSwap

Firebird isn’t alone. The DEX aggregator space is crowded. Here’s how it stacks up:

| Feature | Firebird Finance | 1inch | Kyber Network | ParaSwap |

|---|---|---|---|---|

| Integrated DEXs | 140+ | 120+ | 80+ | 90+ |

| Multi-Chain Support | Ethereum, BSC, Polygon, Arbitrum, Optimism, Base | Same as Firebird | 5 major chains | 6 chains |

| Cashback Rewards | FBA token on every swap | No native cashback | No cashback | No cashback |

| Governance Token | HOPE (currently $0 volume) | 1INCH (active trading) | KNC (active trading) | PSWAP (active trading) |

| Yield Farming | Yes (Farms-as-a-Service) | No | Yes | Yes |

| User Experience | Simple, beginner-friendly | Advanced, feature-heavy | Medium complexity | Very clean UI |

Firebird’s edge? Cashback and ease of use. 1inch has better volume and a stronger governance token. But if you’re swapping $500 a week and want to earn back 0.3% in FBA, that’s $1.50 you wouldn’t get elsewhere. Over a year? $78. That’s real value.

Pros and Cons: Is Firebird Finance Right for You?

Pros:

- One interface for 140+ DEXs across 6 chains

- Real cashback in FBA tokens on every trade

- Farms-as-a-Service removes manual farming hassle

- Simple UI-great for beginners

- Referral program adds passive income

Cons:

- HOPE token has zero trading volume-no liquidity, no value

- Tokenomics feel unbalanced: FBA rewards are real, HOPE is dead weight

- No public audit reports available for smart contracts

- Multi-chain use requires understanding of bridging and gas fees

The HOPE token is the biggest red flag. A governance token with no trading activity isn’t governance-it’s a ghost. If the team can’t get users to hold or use HOPE, the whole voting and fee-sharing system collapses. It’s a design flaw that could kill long-term trust.

Who Should Use Firebird Finance?

Firebird is ideal if:

- You swap crypto regularly and want to earn cashback

- You’re tired of checking 5 different DEXs for the best rate

- You want to farm yield without managing multiple staking contracts

- You’re comfortable with DeFi but don’t want to be a power user

It’s not ideal if:

- You need a trusted governance system with active token holders

- You’re looking for a platform with proven security audits

- You want to trade HOPE or use it for voting

For casual traders and DeFi newbies, Firebird’s simplicity and cashback make it worth trying. For serious DeFi degens who care about token governance and on-chain activity? Look elsewhere.

Getting Started: How to Use Firebird Finance

Here’s how to begin:

- Go to firebird.finance (always verify the URL-scammers copy sites)

- Connect your wallet (MetaMask, Trust Wallet, Coinbase Wallet)

- Select ‘OneSwap’ from the top menu

- Pick your input and output tokens

- Click ‘Swap’ and confirm the transaction in your wallet

- Check your wallet-FBA cashback is automatically sent to you

For farming, go to ‘Farms’ and pick a pool. Click ‘Stake’ and confirm. That’s it. The platform auto-compounds your rewards.

Final Verdict: A Solid Tool With a Broken Token

Firebird Finance delivers on its core promise: better swap rates, cashback, and simplified DeFi. The interface works. The routing algorithm is competitive. The cashback is real. For users who swap regularly, it saves time and money.

But the HOPE token is a liability. A platform built on two tokens needs both to work. If one is worthless, the whole system feels like a house with a beautiful front door and a collapsed back wall. Until HOPE gains traction-or is removed-the platform’s long-term credibility is in question.

Use Firebird for swaps and farming. Earn FBA. Ignore HOPE for now. Keep an eye on their Twitter/X feed (@FirebirdFinance) for updates. If they relaunch HOPE with real utility, this could become a top-tier DeFi hub. Until then? It’s a good tool with a fatal flaw.

Is Firebird Finance safe to use?

Firebird Finance doesn’t hold your funds-you keep control of your wallet. But there’s no public audit report available for its smart contracts. That means there’s a risk of bugs or exploits. Always start with small amounts. Never deposit more than you can afford to lose.

Can I buy HOPE token on Binance or Coinbase?

No. HOPE is not listed on any major exchange. It’s not available for purchase. You can only earn it through platform activities, but as of now, no one is holding it. The token shows $0 price and $0 volume on all tracking sites.

How much FBA cashback can I earn per swap?

You earn between 0.1% and 0.5% of your trade value in FBA tokens, depending on the token pair and your trading volume. Larger swaps get higher rewards. There’s no cap-you earn it every time you swap.

Does Firebird Finance support Solana or Avalanche?

As of 2025, Firebird supports Ethereum, BSC, Polygon, Arbitrum, Optimism, and Base. It does not support Solana, Avalanche, or other chains. The team has mentioned future expansion, but no timeline has been announced.

Is the referral program worth it?

Yes, if you have a network of crypto users. You earn 10% of your referrals’ swap cashback. If one person swaps $1,000/month and earns $3 in FBA, you get $0.30. Multiply that by 10 people? That’s $3/month passive income. It’s small, but it adds up with no effort.

What happens if Firebird Finance shuts down?

If the platform goes offline, you still own your tokens and assets-they’re stored in your wallet. You can still access your FBA and any staked assets via the original blockchain. But you’ll lose access to the Firebird interface, farming tools, and future cashback. Always keep your private keys safe.