Crypto & Blockchain: Real Guides to Tokens, Exchanges, and Regulations

When you hear Crypto, digital assets built on decentralized networks that let people send value without banks. Also known as cryptocurrency, it’s not just Bitcoin anymore—it’s a whole ecosystem of tokens, apps, and rules that change how money moves. Blockchain, the public digital ledger that records every crypto transaction in a way no one can erase. It’s the backbone of everything from DeFi to NFTs, and it’s why you can trade a meme coin one day and vote on a protocol upgrade the next. These aren’t just tech buzzwords—they’re the foundation of how people are moving money, storing value, and building new financial systems outside traditional banks.

DeFi, short for decentralized finance, lets you lend, borrow, or earn interest without needing a bank. Think of it like online banking, but controlled by code instead of people. That’s where tokens like vBNT or AWARE come in—they give you voting power or security alerts, not just speculative value. And then there’s stablecoin regulation, the new wave of laws, like the GENIUS Act, that demand real cash backing for digital dollars. These rules are forcing issuers to clean up or disappear, and they’re changing how safe your holdings really are. Meanwhile, crypto exchanges keep popping up—some with lightning-fast trades and zero KYC, others that vanish overnight with your funds. You’ve got Hermes Protocol for cross-chain swaps, Echobit for high-leverage trading, and Firebird Finance trying to simplify swaps with cashback. But half of them? They’re ghost towns with fake tokens and no support.

What You’ll Find Here

This collection cuts through the noise. You’ll find real breakdowns of tokens that actually do something—like ChainAware.ai’s AI scam detector or Bancor’s governance system—and deep dives into exchanges that still work in 2025. You’ll also see the flip side: meme coins with $34K market caps, stablecoins that don’t stay stable, and airdrops that don’t exist. We don’t just list what’s hot—we tell you what’s hollow, what’s risky, and what’s worth your time. Whether you’re trying to stake BNT, avoid a scam airdrop, or understand why a U.S. law is changing how stablecoins work, you’ll find straight answers here. No hype. No fluff. Just what you need to navigate crypto without getting burned.

Black Mirror Experience (MIRROR) is an officially licensed Netflix crypto token tied to the dystopian TV series. It uses an AI system called Iris to reward fan engagement, but real utility is still unproven. Trading is limited, and adoption is low.

0 Comments

by Tamara Nijburg

Learn the clear line between legal crypto tax avoidance and illegal tax evasion. Know what you must report, how to legally reduce your tax bill, and why hiding crypto gains could land you in trouble with the IRS.

0 Comments

by Tamara Nijburg

US citizens with large crypto holdings are renouncing citizenship to escape worldwide taxation. Learn how the exit tax works, where they go, and whether it’s worth losing your American passport.

0 Comments

by Tamara Nijburg

Coding Dino (DINO) is a meme crypto coin with no team, no utility, and high volatility. Launched in 2025, it trades only on decentralized exchanges and relies entirely on community hype. Learn the risks before investing.

0 Comments

by Tamara Nijburg

A 51% attack lets a single entity control a blockchain's majority hash rate to reverse transactions and steal funds. While Bitcoin is safe due to its massive computing power, smaller cryptocurrencies are vulnerable to low-cost rental attacks. Learn how it works, who's at risk, and how to protect yourself.

0 Comments

by Tamara Nijburg

KYC regulations for blockchain businesses vary by country, with strict rules in the U.S., EU, and Asia. Learn what's required in 2025, how to build compliant systems, and what happens if you fail.

0 Comments

by Tamara Nijburg

Tunisia banned all cryptocurrency in 2018, making it illegal to trade, mine, or hold digital assets. Despite strict penalties, underground use persists. Here's why the ban exists-and whether it might change.

0 Comments

by Tamara Nijburg

Citizens in banking-restricted countries use P2P platforms, no-KYC exchanges, VPNs, and gift cards to access crypto despite government bans. This is how they bypass controls and protect their savings.

0 Comments

by Tamara Nijburg

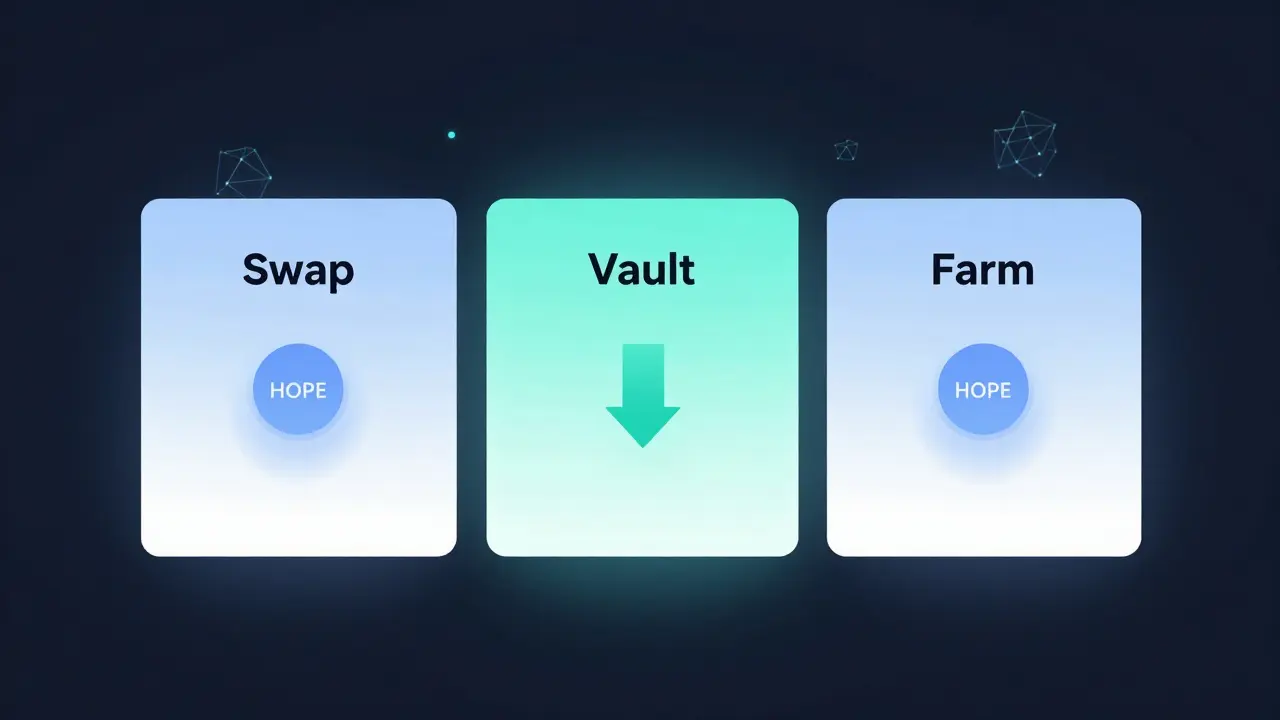

Firebird Finance is a niche Polygon-based DeFi platform offering integrated swapping, auto-compounding vaults, and yield farming-all designed for active traders seeking efficiency. Low TVL but high utility for experienced users.

0 Comments

by Tamara Nijburg

The Mind Music (MND) airdrop in 2022 distributed 30 trillion tokens to 15,000 winners via CoinMarketCap. Learn how it worked, why it faded, and what lessons it offers for crypto-music projects today.

0 Comments

by Tamara Nijburg

The Recharge Incentive Drop airdrop has no official presence and is likely a scam. Learn how to spot fake crypto airdrops, protect your wallet, and find real opportunities in 2026.

0 Comments

by Tamara Nijburg

EtherMuim is not a real crypto exchange - it's a scam site designed to trick users mistyping Ethereum. Learn how to spot fake exchanges and which legitimate platforms to use instead.

0 Comments

by Tamara Nijburg