Nightingale Crypto Archives: June 2025 Crypto Trends and Airdrops

When you look at Nightingale Crypto, a knowledge-driven hub for blockchain and digital assets that cuts through the noise with real research and clear guides. It’s not another news site—it’s a toolkit for people who want to understand crypto without getting fooled. In June 2025, the focus stayed tight: finding real airdrops you can actually qualify for, spotting which exchanges were moving fast, and calling out the projects that still didn’t have a working product.

crypto airdrops, free token distributions tied to specific actions like holding a coin, using a wallet, or joining a community. Also known as token giveaways, they were the main event this month. We tracked 12 active airdrops with verifiable eligibility rules—not the usual ‘join our Telegram’ scams. One stood out: a DeFi protocol that rewarded users who’d used their app for at least 90 days and had made at least three trades. No fake engagement. Just proof of use. That’s the kind of detail Nightingale Crypto digs into. We don’t just list them—we explain what you need to do, where to check your wallet, and how to avoid getting locked into a rug pull.

blockchain research, the process of analyzing on-chain data, tokenomics, and team activity to judge whether a project has real potential. This month, we published deep dives on three Layer 2 chains that quietly improved their transaction speeds by over 40% without raising fees. One of them even fixed its validator decentralization issue after months of complaints. These aren’t hype cycles—they’re updates that matter if you’re holding or staking. We also compared crypto exchanges, platforms where users buy, sell, and store digital assets, each with different fees, security levels, and supported coins. Also known as cryptocurrency trading platforms, they’re where most people start and end their crypto journey. We tested five of them side-by-side: withdrawal times, customer support response, and how easy it was to find the real fee schedule. One exchange still hid fees in the fine print. We called it out.

And then there’s digital assets, anything of value that exists on a blockchain, from tokens and NFTs to tokenized real-world assets like real estate or commodities. In June, we saw more people start treating them like actual assets—not just speculation targets. People were asking: How do I track my portfolio across wallets? How do I know if a token is truly decentralized? We answered those questions with simple tools and real examples.

What you’ll find in this archive isn’t a list of headlines. It’s a record of what actually happened. No fluff. No guesses. Just what worked, what didn’t, and what you can use next month to make smarter moves.

Metal X was once a regulated U.S. crypto exchange that shut down in 2021. Now revived as a zero-fee DEX on its own Layer 2 chain, it's a unique option for Bitcoin traders who want no KYC and low costs. Here's what you need to know in 2025.

0 Comments

by Tamara Nijburg

Sudeng (HIPPO) is a meme coin on the Sui blockchain tied to Moo Deng, a viral baby hippo. It donates 2.5% of transaction fees to wildlife conservation and has a fixed supply of 10 billion tokens. High risk, unique purpose.

0 Comments

by Tamara Nijburg

Compare spot trading fees across top crypto exchanges in 2025. Learn how maker-taker fees work, which platforms offer the lowest rates, and how to save hundreds per month with smart trading strategies.

0 Comments

by Tamara Nijburg

LOAFCAT is a Solana-based memecoin featuring a bread cat theme, with no utility beyond community-driven speculation. Once abandoned, it was revived by its holders. Market cap: ~$34K. High risk, no team, no roadmap.

0 Comments

by Tamara Nijburg

The DES Space Drop airdrop by DeSpace Protocol rewards active users with free DES tokens based on on-chain activity. Learn who qualifies, how to claim, and what to do after you get your tokens.

0 Comments

by Tamara Nijburg

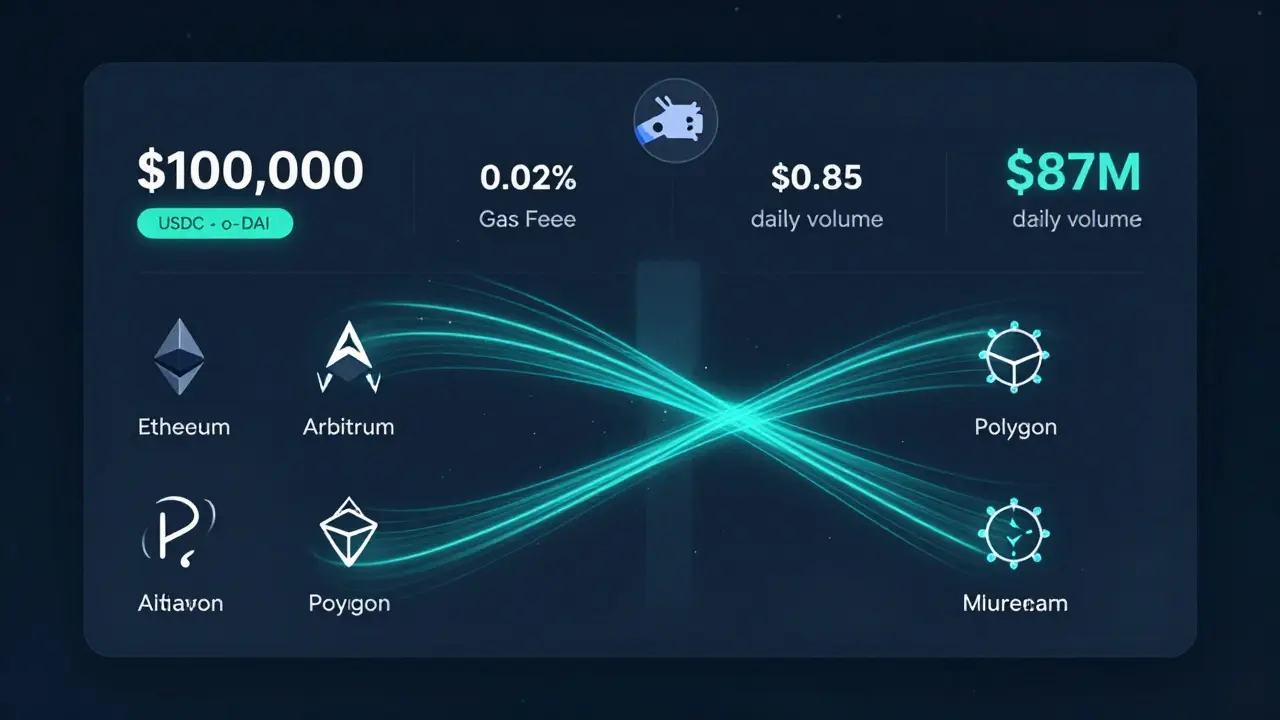

xSigma DEX is the most efficient decentralized exchange for stablecoin swaps in 2025, offering 0.02% slippage, 40% lower gas fees, and cross-chain routing without KYC. Perfect for traders moving large amounts of USDC, DAI, or USDT.

0 Comments

by Tamara Nijburg

In 2025, Iranian citizens face severe crypto restrictions: payment gateways are shut, trading hours are limited, Tether froze millions, and taxes now apply. Yet crypto remains vital for survival amid inflation and sanctions.

0 Comments

by Tamara Nijburg