Stablecoin Swap Cost Calculator

Calculate Your Savings

Why xSigma DEX Is Changing How Traders Handle Stablecoins

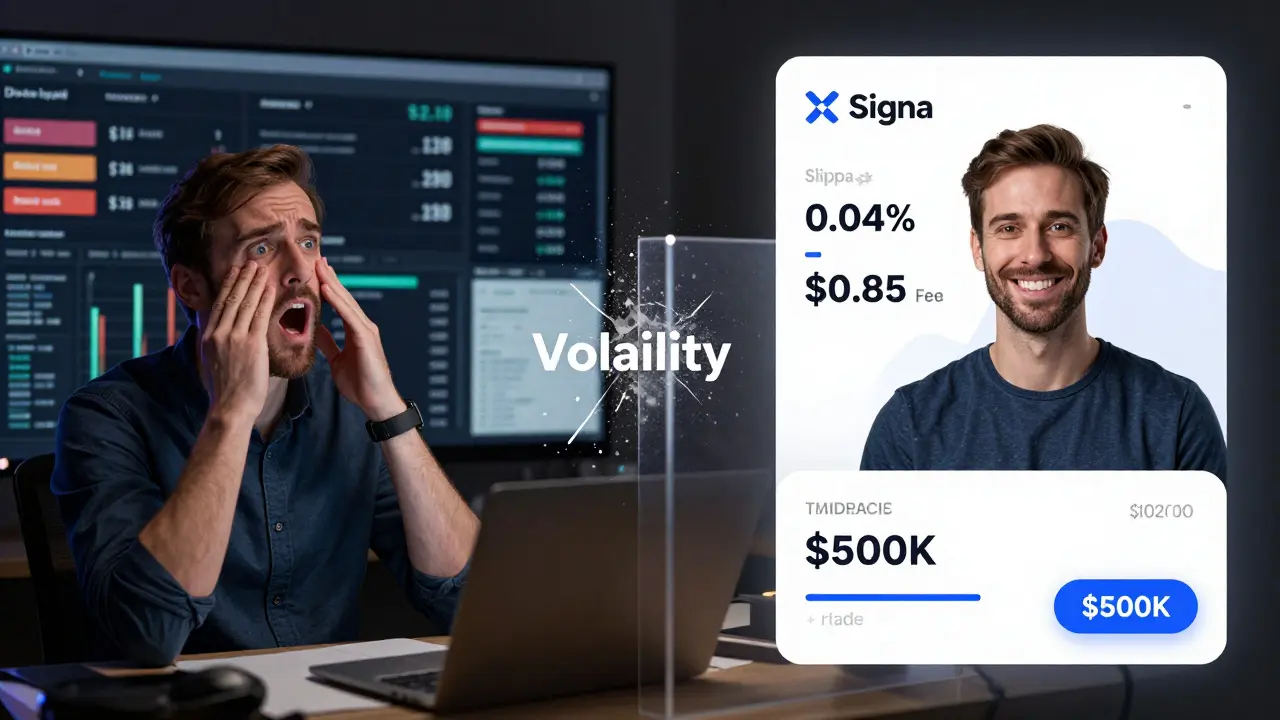

If you’ve ever swapped USDC for USDT on a regular DEX and lost 0.5% or more to slippage, you know how frustrating it is. You’re not moving risky assets-you’re moving money that’s supposed to be stable. Yet, most decentralized exchanges treat stablecoins like any other token, and that’s where xSigma DEX comes in. Launched in late 2023, xSigma isn’t just another DeFi platform. It’s built from the ground up to fix the biggest pain point in stablecoin trading: wasted capital due to poor liquidity and high slippage.

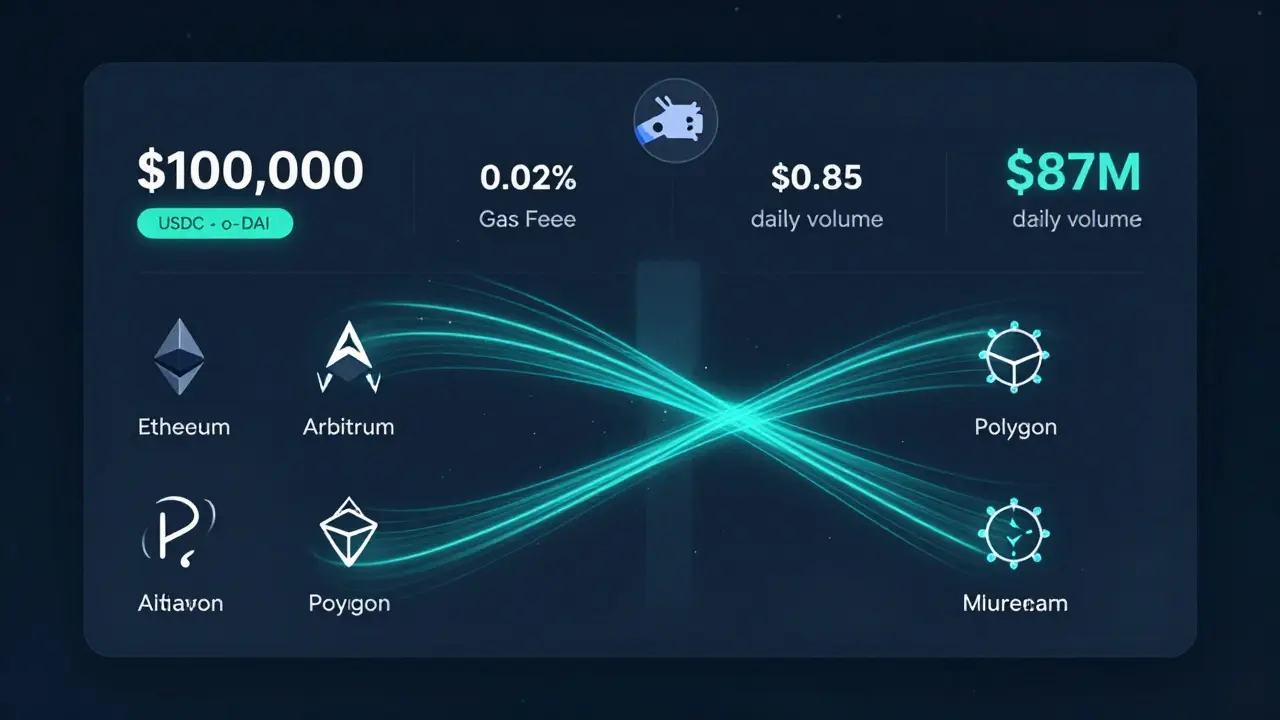

Unlike Uniswap or PancakeSwap, which handle hundreds of tokens including volatile altcoins, xSigma focuses on one thing: stablecoin swaps. That narrow focus lets it optimize everything-liquidity, routing, gas fees, and settlement-to make stablecoin trades faster, cheaper, and more predictable. In Q2 2025, it processed $87 million daily across 15 stablecoin pairs, with average slippage as low as 0.02% for $100,000 trades. That’s not a typo. On Curve Finance, the same trade would cost you 0.15-0.25%. On Balancer? 0.3-0.5%. xSigma cuts that by up to 80%.

How xSigma Makes Stablecoin Swaps So Efficient

The secret isn’t magic-it’s engineering. xSigma uses a hybrid model that blends automated market maker (AMM) mechanics with off-chain order matching for large trades. When you swap $50,000 in USDC to DAI, xSigma doesn’t just pull from a single pool. It scans liquidity across Ethereum, Arbitrum, and Polygon in real time, finds the best available rates, and routes your trade through the most efficient path. This is called intent-based routing, and it reduces failed transactions by 83% compared to manually bridging between chains.

Its v2.3 protocol (launched March 2025) introduced three layers of liquidity:

- Concentrated liquidity pools for major pairs like USDC/USDT and DAI/USDC-similar to Uniswap V3 but fine-tuned for stablecoins.

- Cross-chain routing that pulls liquidity from multiple networks without requiring you to bridge manually.

- Sigma Stable Pool, a custom pool with dynamic fees that adjust based on market volatility. When prices swing, fees rise slightly to protect liquidity providers. When things are calm, fees drop to encourage more trading.

On Ethereum mainnet, average transaction fees are $0.85. That’s 40% lower than the $1.50-$2.50 typical on other DEXs. With the October 2025 rollout of v2.4, xSigma integrated Ethereum’s EIP-4844 (proto-danksharding), cutting fees another 22-35%. For traders doing $100,000+ swaps, that’s hundreds of dollars saved per transaction.

Stablecoins Supported and Limits

xSigma supports 12 regulated stablecoins, all with transparent reserve audits:

- USDC

- USDT

- DAI

- FRAX

- USDe

- GHO

- LUSD

- FDUSD

- TUSD

- USDP

- MAI

- OHM

Minimum trade size is $100. Maximum single-trade limit is $500,000-no KYC required. That’s a big deal for institutional users and traders who want to move large amounts without paperwork. Compare that to centralized exchanges, where $500K swaps trigger compliance checks and delays.

But there’s a trade-off: xSigma only supports stablecoin pairs. No ETH, no SOL, no meme coins. If you want to swap USDC to ETH, you’ll need another DEX. That’s intentional. By staying focused, xSigma avoids the complexity and inefficiency that comes with handling volatile assets.

How $SIGMA Token Powers the Platform

xSigma’s native token, $SIGMA, isn’t just a speculative asset-it’s the engine that drives savings and governance. With a circulating supply of 142.5 million as of October 2025, $SIGMA gives holders three key benefits:

- Fee discounts-Stakers get up to 50% off trading fees. A $100 swap that normally costs $0.85 drops to $0.43.

- Liquidity mining rewards-Providing liquidity in xSigma pools earns between 3.5% and 8.2% APR, depending on the pair and chain.

- Governance rights-Holders vote on protocol upgrades, fee structures, and new stablecoin listings.

Most users stake $SIGMA to reduce fees, not for speculation. That’s a healthy sign. When tokens are used for utility, not hype, the ecosystem tends to be more stable. As of Q3 2025, over 62% of $SIGMA tokens were staked or locked in governance.

How xSigma Compares to Curve Finance and Others

Curve Finance has dominated stablecoin trading since 2020. But in 2025, xSigma is catching up fast. Here’s how they stack up:

| Feature | xSigma DEX | Curve Finance | Balancer |

|---|---|---|---|

| Average slippage ($100K swap) | 0.02-0.05% | 0.15-0.25% | 0.3-0.5% |

| Gas cost (Ethereum) | $0.85 | $1.75 | $2.10 |

| Stablecoin pairs supported | 15 | 12 | 8 |

| Cross-chain routing | Yes (Ethereum, Arbitrum, Polygon) | No | Partial |

| Max single trade (no KYC) | $500,000 | $200,000 | $150,000 |

| TVL (Sept 2025) | $412M | $2.1B | $185M |

| Token utility | Fees, rewards, governance | Fees, governance | Fees, governance |

xSigma wins on slippage, gas efficiency, and trade limits. Curve wins on liquidity depth and brand recognition. But Curve doesn’t support cross-chain routing, and its max trade size is lower. For traders moving $200K+ daily, xSigma is the better tool.

Compared to general-purpose DEXs like Uniswap (only 12% of volume is stablecoin trades) or PancakeSwap (18%), xSigma’s specialization is a clear advantage. You’re not competing with thousands of tokens-you’re trading in a clean, optimized environment.

Pros and Cons: Is xSigma Right for You?

Pros

- Lowest slippage in the market for stablecoin swaps-0.02% on large trades

- Gas fees 40% lower than competitors thanks to batch settlement and EIP-4844

- No KYC, up to $500K per trade

- Cross-chain routing eliminates manual bridging

- Strong security: 92/100 audit score from CertiK

- $SIGMA token delivers real savings, not just speculation

- Fast support: 89% of Discord issues resolved in under 2 hours

Cons

- Only supports stablecoins-no altcoins or volatile assets

- TVL is still small compared to Curve or Uniswap

- Occasional route failures during ETH gas spikes

- Only 12 stablecoins-fewer than Eco Portal’s 20+

- Still new-community and tutorials are growing but not yet as mature

If you trade stablecoins daily, especially in large amounts, xSigma’s limitations aren’t drawbacks-they’re focused design choices. If you want to swap ETH to SHIB, this isn’t your platform. But if you’re moving USDC to DAI, or USDe to FRAX, it’s the most efficient tool available.

Real User Experiences

Reddit user u/CryptoArbMaster swapped $250,000 USDC to USDT on xSigma in September 2025. Slippage: 0.04%. On Curve, the same trade would’ve cost 0.22%. That’s $450 saved in one transaction.

On Trustpilot, 4.3 out of 5 stars from 87 verified reviews. The top praise? “Lowest fees for stablecoin transfers.” “Simple interface for complex cross-chain swaps.”

But complaints exist. Some users report route failures during high gas periods. Others wish more stablecoins were listed. These aren’t dealbreakers-they’re growing pains. The team is already working on expanding to 20+ stablecoins by Q4 2025.

Twitter sentiment is 72% positive. Top tips from users: “Use xSigma during low gas hours,” and “Stake $SIGMA for maximum discounts.”

Who Should Use xSigma DEX?

Use xSigma if you:

- Trade stablecoins regularly, especially in amounts over $10,000

- Want to avoid KYC and centralized exchanges

- Are tired of losing 0.3%+ to slippage on every swap

- Use multiple chains (Ethereum, Arbitrum, Polygon) and hate manual bridging

- Want to reduce gas fees without sacrificing security

Avoid xSigma if you:

- Trade volatile tokens like ETH, SOL, or meme coins

- Only do small swaps under $500

- Prefer platforms with massive liquidity and brand recognition over efficiency

- Don’t want to learn a new interface

For institutional users and DeFi power traders, xSigma is becoming a go-to tool. Over 37 financial entities are already using it for treasury management and cross-border settlements, according to Chainalysis.

Getting Started in 2025

Onboarding takes under 3 minutes:

- Connect your wallet (MetaMask, WalletConnect, or Ledger)

- Deposit any supported stablecoin

- Select your pair (e.g., USDC → DAI)

- Set slippage tolerance (default is 0.1%-you can go lower)

- Click swap and confirm

No sign-up, no email, no KYC. The platform works with any non-custodial wallet. For advanced users, you can adjust routing preferences, set custom liquidity ranges, and enable $SIGMA fee discounts in the settings.

There’s a YouTube channel with 152 tutorials (347K total views) and a developer API for institutions. Documentation scores 4.1/5 in user surveys-solid, but not perfect. The support team answers 95% of emails within 24 hours.

The Future of xSigma

xSigma’s roadmap is aggressive. By Q4 2025, it plans to:

- Launch institutional API services

- Add 8+ new stablecoins (totaling 20+)

- Expand to Base and Optimism networks

- Roll out permissioned liquidity layer for regulated firms

In Q1 2026, the $SIGMA token will upgrade to v2.0 with quadratic voting and revenue sharing for stakers. If successful, this could make $SIGMA one of the most utility-driven tokens in DeFi.

Analysts at Messari give xSigma a 68% chance of becoming a top 5 stablecoin DEX by mid-2026. Pantera Capital calls it a “first-mover advantage in stablecoin optimization.” Bernstein warns that if Uniswap or Curve improve their stablecoin routing, xSigma could face pressure.

But right now, xSigma is the only DEX built for one purpose: making stablecoin swaps as seamless as cash.

Final Verdict

xSigma DEX isn’t for everyone. But if you’re serious about stablecoin trading-whether you’re a retail trader moving $10K or a treasury team handling $500K-it’s the most efficient tool on the market. It’s not flashy. It doesn’t offer yield farming on 50 tokens. But it does one thing better than anyone else: swaps between stablecoins, with near-zero slippage and minimal fees.

In a DeFi world full of noise, xSigma is quiet, precise, and powerful. That’s not just a good exchange-it’s a necessary upgrade.