MiCA Compliance Assessment Tool

Your Business Profile

Your Compliance Requirements

Starting December 30, 2024, if your crypto business wants to serve customers in the European Union, you either comply with MiCA or you don’t operate there at all. There’s no middle ground. This isn’t a suggestion. It’s the law. And it’s already changing who’s still in the game.

What MiCA Actually Is (And Why It Matters)

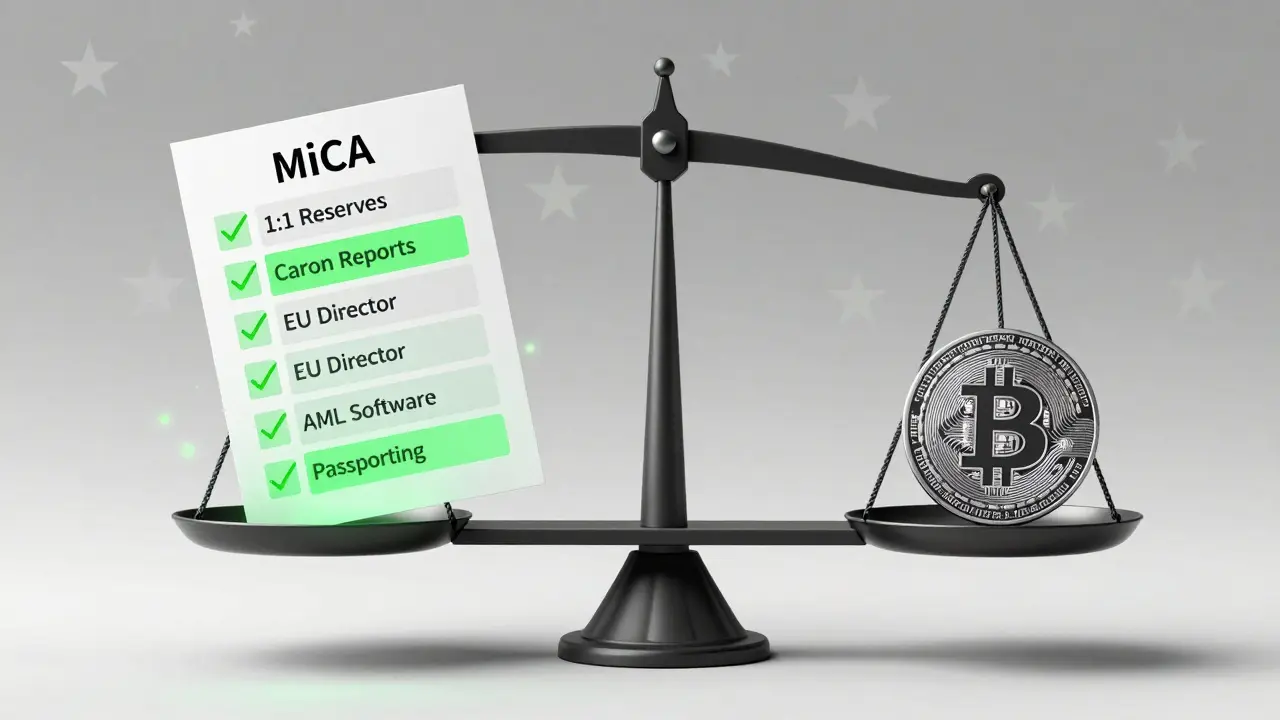

MiCA stands for Markets in Crypto-Assets. It’s the European Union’s first unified rulebook for crypto. Before MiCA, every EU country had its own rules. Some were strict. Others were loose. That made it messy for any business trying to scale across borders. Now, one set of rules applies to all 27 EU countries. If you’re licensed in France, you can offer services in Germany, Italy, Spain - no extra paperwork. That’s the passporting system. But here’s the catch: MiCA doesn’t just cover exchanges. It applies to anyone issuing tokens, running stablecoins, or offering crypto services professionally. That means if you’re a DeFi protocol, a token issuer, or a wallet provider with EU users, you’re in scope. The EU doesn’t care if you’re decentralized. If you’re serving EU customers, you’re regulated.Who Has to Comply? The Three Big Categories

MiCA breaks crypto businesses into three buckets. If you fall into any of these, you need to act.- Crypto-Asset Service Providers (CASPs): This includes exchanges, custody providers, brokers, and any platform that trades, holds, or transfers crypto for others. If your business makes money from crypto services in the EU, you need authorization.

- Token Issuers: If you’re launching a utility token, security token, or any asset-referenced token, you must publish a whitepaper approved by a national regulator. No more vague marketing docs. You need technical specs, risk disclosures, and even environmental impact reports.

- Stablecoin Issuers: If your stablecoin hits €1 billion in market cap or serves over 15 million EU users, you’re a “significant” stablecoin. That triggers daily reserve checks, redemption rights, and direct oversight from ESMA.

The Real Cost of Getting Authorized

Getting a CASP license isn’t cheap. Based on real applications filed in 2024, businesses spent between €500,000 and €1.2 million just to get started. That includes:- Setting up a physical office in the EU - minimum 20m² per 5 employees

- Hiring an EU-resident director with financial services experience

- Employing a certified compliance officer (CAMS credential required)

- Buying AML software - €80,000 to €200,000 per year

- Writing and approving a whitepaper - €35,000 for simple tokens, up to €150,000 for stablecoins

Stablecoin Rules Are the Hardest Part

If you’re issuing a stablecoin backed by euros or other assets, MiCA demands 1:1 reserves. Not “mostly” backed. Not “mostly” liquid. Exactly 1:1. And you have to prove it daily. For stablecoins with over €1 billion in circulation or 15 million active EU users, the rules get even tighter:- Reserves must be held in high-quality liquid assets - cash, government bonds, nothing risky

- Users must be able to redeem their tokens for euros within one business day

- You must publish quarterly stress tests showing you can survive a bank run

- ESMA can step in and freeze your operations if they see trouble

Environmental Reporting Isn’t Optional

MiCA is the first major crypto regulation to force environmental disclosures. Every CASP must publicly report the carbon footprint of their crypto activities. This hits proof-of-work coins hardest - Bitcoin mining, for example. But even proof-of-stake chains like Ethereum need to explain their energy use. In November 2024, Sanctions.io found that 35% of Ethereum-based projects had to revise their whitepapers because their environmental impact reports were too vague. You can’t just say “we’re eco-friendly.” You need numbers: kWh per transaction, source of energy, projected emissions over the next year.How MiCA Compares to the Rest of the World

The U.S. still has a patchwork of regulators - SEC, CFTC, state laws. No single rulebook. Singapore and Switzerland are more lenient. Japan allows stablecoins with annual audits. MiCA is stricter on every front:- Travel Rule: MiCA requires monitoring all crypto transfers over €1,000. The U.S. only enforces this above $3,000.

- Anonymous wallets: MiCA bans anonymous wallets. You must know who owns the address. No exceptions.

- Market abuse: Fines for insider trading or market manipulation can be up to twice the profit gained - higher than Hong Kong or the UK.

- Passporting: One license, 27 countries. The UK requires separate registrations for each service.

Who’s Winning and Who’s Getting Left Behind

Since MiCA went live, the EU crypto market has shrunk - but gotten stronger. The number of active crypto businesses serving EU customers dropped from 1,850 in January 2024 to 1,240 by December 2024. That’s a 33% decline. But total market capitalization rose 37%. Why? Because the big players are moving in. BNP Paribas, Deutsche Bank, and six other major banks got CASP licenses in 2024. Fortune 500 companies are now exploring tokenization under MiCA’s clear rules. Meanwhile, 42% of non-EU crypto firms opened EU subsidiaries just to stay compliant. Another 28% blocked EU users entirely. On Reddit, one user said: “After getting French authorization, passporting to Spain and Portugal was seamless. We’re now in 15 EU countries.” That’s the upside. But another user complained: “BaFin rejected our whitepaper three times because we didn’t detail our carbon offset plan.” That’s the cost.

What Happens If You Ignore MiCA?

You won’t get a warning. You won’t get a chance to fix it. If you’re serving EU customers without authorization, regulators can:- Freeze your bank accounts in the EU

- Block your website from EU IPs

- Impose fines up to 5% of your global revenue

- Bar your executives from working in EU financial markets

What’s Next? Updates Coming in 2025

MiCA isn’t frozen in time. In March 2025, new rules take effect on how proof-of-work and proof-of-stake energy use must be reported. In Q3 2025, the EU will review the €1 billion stablecoin threshold - it might go lower. Switzerland and the UK are negotiating equivalence deals. If they succeed, a Swiss-licensed firm could operate in the EU without a full MiCA license. That could ease the burden for some. But here’s the reality: MiCA is here to stay. By 2026, 78% of all crypto transactions involving EU residents will be handled by MiCA-compliant firms, according to Gartner. The market is shifting - fast.What You Need to Do Right Now

If you’re a crypto business and you have EU users:- Figure out if you’re a CASP, issuer, or stablecoin operator.

- Choose your EU base country - Luxembourg or France are fastest.

- Start your whitepaper or compliance plan immediately - it takes 3 to 9 months.

- Set up a physical EU office and hire your EU-resident director.

- Buy AML software and get your compliance officer certified.

- Map out your environmental impact and prepare your disclosures.

- Block EU traffic if you’re not ready - the risk isn’t worth it.

Does MiCA apply to decentralized finance (DeFi) protocols?

Yes - if your DeFi protocol offers services like trading, lending, or custody to EU users, you’re considered a CASP. Even if you’re decentralized, if you have EU customers and generate revenue from those services, MiCA applies. Most DeFi projects haven’t complied yet, but regulators are actively identifying them through on-chain analysis and user data.

Can I avoid MiCA by not having an EU office?

No. MiCA applies based on who you serve, not where you’re based. If your website accepts EU customers, you’re in scope. Many businesses try geo-blocking, but regulators can still trace users through payment processors, IP addresses, or third-party services. If you’re knowingly serving EU users without authorization, you’re violating the law.

What happens if my stablecoin drops below €1 billion in market cap?

You still need to comply with basic MiCA rules for stablecoins - 1:1 reserves, daily redemptions, and whitepaper disclosures. Only the “significant” stablecoin requirements (like ESMA oversight and quarterly stress tests) are lifted. You can’t just relax compliance. The core rules still apply.

Do I need to report every single crypto transaction?

No. MiCA’s Travel Rule requires you to collect and share identity data only for transfers over €1,000. Smaller transactions don’t trigger reporting. But you still need systems in place to detect and flag larger transfers. Many platforms use automated tools to scan wallets and flag high-value transfers automatically.

Can I use a third-party provider to handle MiCA compliance?

You can outsource parts of compliance - like AML screening or reporting tools - but you can’t outsource responsibility. You still need an EU-resident director, a physical office, and internal controls. Regulators hold the legal entity accountable, not the vendor. If your third-party fails, you’re still liable.

Is MiCA going to be updated soon?

Yes. The European Commission is scheduled to review MiCA’s stablecoin rules in Q3 2025. There’s also ongoing work to clarify how zero-knowledge proofs and DePIN networks fit under the regulation. ESMA has already admitted these areas weren’t fully covered in the original text. Expect tighter rules on privacy-focused tech in the next 12 to 18 months.