Firebird Finance: What It Is, Why It Matters, and What You Need to Know

When you hear Firebird Finance, a decentralized finance protocol that rewards liquidity providers with native tokens across multiple blockchains. It's not a coin, not a wallet, and not an exchange—it's a smart contract system designed to move money between users and earn rewards without intermediaries. Think of it like a digital lending library where you deposit crypto, and instead of just getting your stuff back, you earn extra tokens just for letting others use it. That’s the core idea behind most DeFi protocols, and Firebird Finance is one of the newer ones trying to stand out with multi-chain support and lower fees.

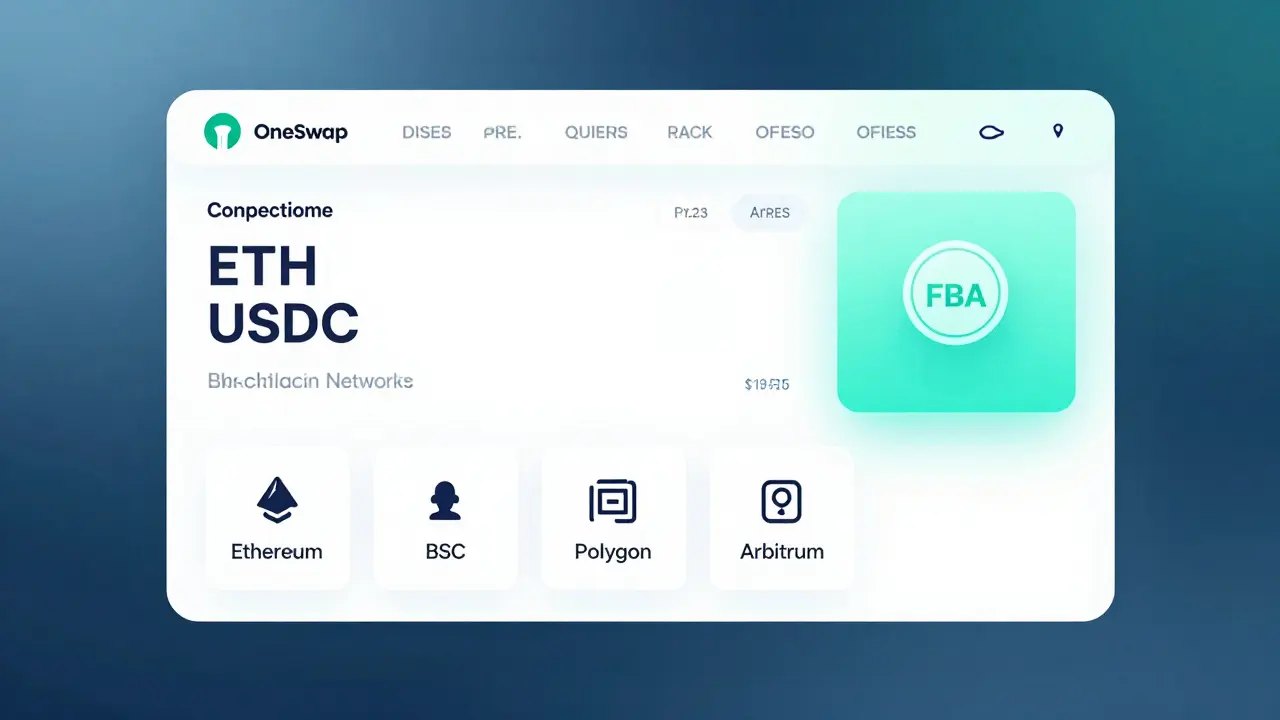

It’s closely tied to yield farming, the practice of locking up crypto in smart contracts to earn interest or rewards. Firebird Finance doesn’t invent this—it builds on it. Users deposit pairs like ETH/USDC or SOL/USDT into liquidity pools, and in return, they get Firebird’s native token as a reward. This is similar to what you’d see on Uniswap or SushiSwap, but Firebird focuses on chains with lower gas costs, like Polygon, Arbitrum, and BSC. That makes it attractive for small traders who don’t want to pay $50 in fees just to earn $3 in rewards.

But here’s the catch: most of these systems rely on constant new money coming in to keep rewards high. If users stop depositing, or if the token price drops, rewards shrink fast. That’s why so many Firebird-style projects burn out within months. The blockchain rewards, incentive structures built into DeFi protocols to attract and retain users. are often unsustainable by design. Firebird Finance isn’t an exception—it’s an example. It’s a tool for experienced DeFi users who know how to read tokenomics, track liquidity, and exit before the rug pull. It’s not for beginners who think "free crypto" means free money.

What you’ll find in the posts below isn’t hype. It’s real breakdowns of what Firebird Finance actually does, how its token works, which chains it runs on, and whether the rewards are worth the risk. You’ll also see how it compares to other similar protocols, what went wrong for users who held too long, and why some people walked away with profits while others lost everything. This isn’t a guide to getting rich. It’s a guide to not getting fooled.