Back in 2020, if you were new to crypto and wanted to buy Bitcoin with a credit card, Bidesk looked like a solid option. It promised low fees, a clean interface, and easy deposits. But by October 2021, it was gone-no warning, no notice, just a shutdown announcement. If you’re wondering whether Bidesk was ever safe, or why it disappeared, here’s the full story.

What Was Bidesk?

Bidesk was a cryptocurrency exchange launched in October 2019 and registered in the British Virgin Islands. It targeted beginners who wanted to trade crypto without getting lost in complex tools. Unlike Binance or Coinbase, it didn’t offer hundreds of coins. It focused on a few major pairs: BTC/USDT, ETH/USDT, and BCH/USDT. That made it simple, but also limited.

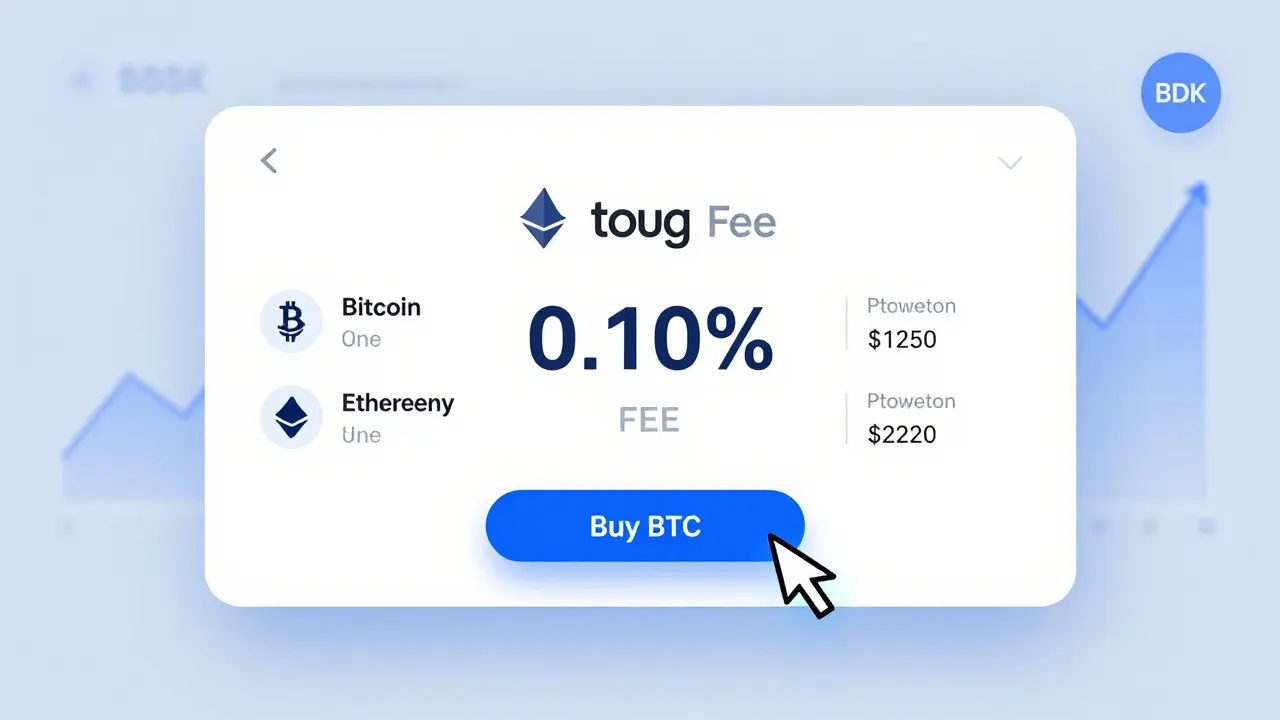

Its biggest selling point? A flat 0.10% trading fee for both makers and takers. At the time, most exchanges charged 0.20% or more. Even Coinbase was at 0.50%. Bidesk’s fee structure was one of the lowest on the market. If you traded $1,200 in Bitcoin over three months, you’d pay just $1.20 in fees-exactly as advertised.

It also had its own token, BDK (Bidesk Token), an ERC-20 token on Ethereum with a fixed supply of 100 million. Holding BDK gave you discounted trading fees, early access to IEOs, and entry to exclusive events. But here’s the catch: BDK had no burning mechanism. No buybacks. No demand drivers. Just a token with no real utility beyond discounts.

How Bidesk Compared to Other Exchanges

Compared to giants like Binance or Coinbase, Bidesk was tiny. In Q3 2021, its 24-hour trading volume was around $28.7 million. Binance was doing $24.5 billion. Coinbase, $3.2 billion. Bidesk wasn’t even in the top 50. It ranked #187 globally.

Where it did well was in simplicity. Its app and website were clean. No cluttered charts, no confusing order types. Just buy, sell, and track. That’s why many beginners liked it. But advanced traders quickly hit walls. No stop-loss orders. No limit orders beyond basic types. No API support for bots. And when markets moved fast, the platform often crashed-users reported 500 errors during volatility spikes.

It supported fiat deposits via Moonpay, letting you buy crypto with Visa or Mastercard. But the fees were steep: 4.50% for cards, 1.00% for wire transfers. That’s higher than most exchanges, which typically charged 3.5-4.0% for cards. Withdrawals, though? Free. You only paid the blockchain network fee. Most exchanges added their own 0.5-1.0% fee on top. That was a rare win for users.

Security and Trust Issues

Bidesk claimed to use cold storage, two-factor authentication, and encryption. No details were ever published. No third-party audit reports. No transparency. That’s a red flag. In crypto, if an exchange doesn’t publish its security audits, you’re trusting guesswork.

Then there was the jurisdiction. Operating out of the British Virgin Islands meant no oversight from the U.S., EU, or UK. That’s not illegal-but it’s risky. Exchanges in these offshore zones had a 34.2% failure rate between 2018 and 2021, according to CryptoCompare. Bidesk wasn’t alone. KuCoin and BitMEX also operated from similar jurisdictions. But unlike them, Bidesk never built a strong user base or liquidity pool.

Users on Reddit and Trustpilot reported slow customer support-72 hours to get a reply. Withdrawals took an average of 8.2 hours, compared to the industry standard of 2.1 hours. In July 2021, dozens of users couldn’t withdraw funds for three days during a platform outage. Bidesk eventually fixed it, but the damage was done. Trust eroded.

Why Did Bidesk Shut Down?

The shutdown on October 22, 2021, wasn’t sudden-it was inevitable.

First, trading volume was too low. CryptoCompare found that exchanges needed at least $50 million in daily volume to stay profitable. Bidesk averaged $28.7 million. It was bleeding money.

Second, the BDK token failed. With no burning, no staking, no utility beyond fee discounts, the token’s value flatlined. By October 2021, it was trading at $0.012. Around $1.2 million in BDK tokens were stuck in wallets. When the exchange closed, those tokens became worthless. CoinGecko delisted them immediately.

Third, regulatory pressure was mounting. The U.S. and EU were cracking down on offshore exchanges. Bidesk banned users from the U.S. and Canada. That cut off a huge market. Its user base was mostly in Asia and Latin America-smaller, less liquid markets.

Finally, the platform’s technical issues piled up. Mobile apps crashed on Android 8+. Web interfaces timed out during high traffic. The API was unreliable. Bot traders abandoned it. No one was building tools or tutorials around it. The community was tiny: just 2,300 members in a Telegram group. No subreddit. No documentation beyond basic guides.

Delphi Digital had already rated Bidesk a 7.8/10 on its failure risk scale. The three biggest risks? Lack of oversight, thin liquidity, and over-reliance on BDK. All three came true.

What Happened to Your Funds?

If you had crypto on Bidesk when it shut down, you lost it. No migration path. No refund. No announcement beyond a one-line note on the website. Users reported emails going unanswered. Support channels vanished. Even the official Twitter account went silent.

BDK token holders had no recourse. No exchange offered to swap them. No team released a recovery plan. The token’s smart contract was immutable. No one owned it. No one could change it. The money was gone.

Wallet Scrutiny called it a classic case of “structural instability.” Smaller exchanges from offshore jurisdictions often rise fast, attract beginners with low fees, then collapse when volume doesn’t keep up. Bidesk was textbook.

Lessons from Bidesk’s Failure

Bidesk wasn’t a scam. It didn’t steal funds. It just failed to survive. But its downfall teaches you three things:

- Don’t trust low fees alone. A 0.10% fee means nothing if the exchange can’t keep your money safe.

- Watch the jurisdiction. If an exchange isn’t licensed in the U.S., EU, or UK, you’re taking a bigger risk.

- Never hold all your assets on one exchange. Especially not one with a native token that has no real demand.

Today, Bidesk is a ghost. Its website is offline. Its app is gone. Its tokens are dead. It’s a cautionary tale for anyone who thinks a simple interface and low fees are enough.

If you’re looking for a beginner-friendly exchange today, stick with regulated platforms like Kraken, Coinbase, or Bitstamp. They charge more, but they’re still around. And that’s what matters.

Was Bidesk a scam?

No, Bidesk wasn’t a scam in the traditional sense. It didn’t steal money or run a Ponzi scheme. It was a real exchange that operated for over two years. But it failed to sustain itself due to low trading volume, poor liquidity, and lack of regulatory oversight. When it shut down, users lost access to their funds because there was no recovery plan. That’s not fraud-it’s incompetence.

Could I have withdrawn my crypto before the shutdown?

Yes, technically. But many users reported delays. Withdrawals averaged 8.2 hours, much longer than the industry standard of 2.1 hours. In the final weeks before shutdown, some users couldn’t withdraw at all due to server outages. If you waited until October 2021, you were likely too late. The platform stopped processing withdrawals shortly before the official shutdown announcement.

What happened to the BDK token?

The BDK token became worthless. With no burning mechanism, no staking, and no exchange willing to list it after Bidesk shut down, its value dropped to zero. CoinGecko delisted it immediately. Over $1.2 million worth of BDK tokens are now permanently locked in wallets with no way to recover them.

Why did Bidesk ban users from the U.S. and Canada?

Bidesk banned U.S. and Canadian users because it lacked licenses from American or Canadian regulators. Exchanges that operate without these licenses risk fines, lawsuits, or criminal charges. By blocking those users, Bidesk avoided legal exposure-but it also cut off access to the largest crypto market in the world, which hurt its trading volume.

Is there any way to recover lost funds from Bidesk?

No. There is no official recovery process, no legal recourse, and no team left to respond. The exchange’s servers are offline. Its domain is no longer active. The BDK smart contract cannot be altered. If you held funds on Bidesk, they are permanently lost. This is why experts always say: never keep large amounts on any exchange, especially unregulated ones.