xSigma Review: What It Is, How It Works, and If It's Worth Your Crypto

When you hear xSigma, a DeFi protocol designed to optimize yield across multiple blockchains. It's not a coin you buy to hold—it's a tool used by active traders and yield farmers looking to squeeze more returns out of their crypto without moving assets between chains. Unlike most DeFi projects that rely on complex bridges or unstable liquidity pools, xSigma tries to simplify yield generation by combining automated strategies with low-slippage swaps. But does it actually deliver, or is it just another name in a sea of DeFi noise?

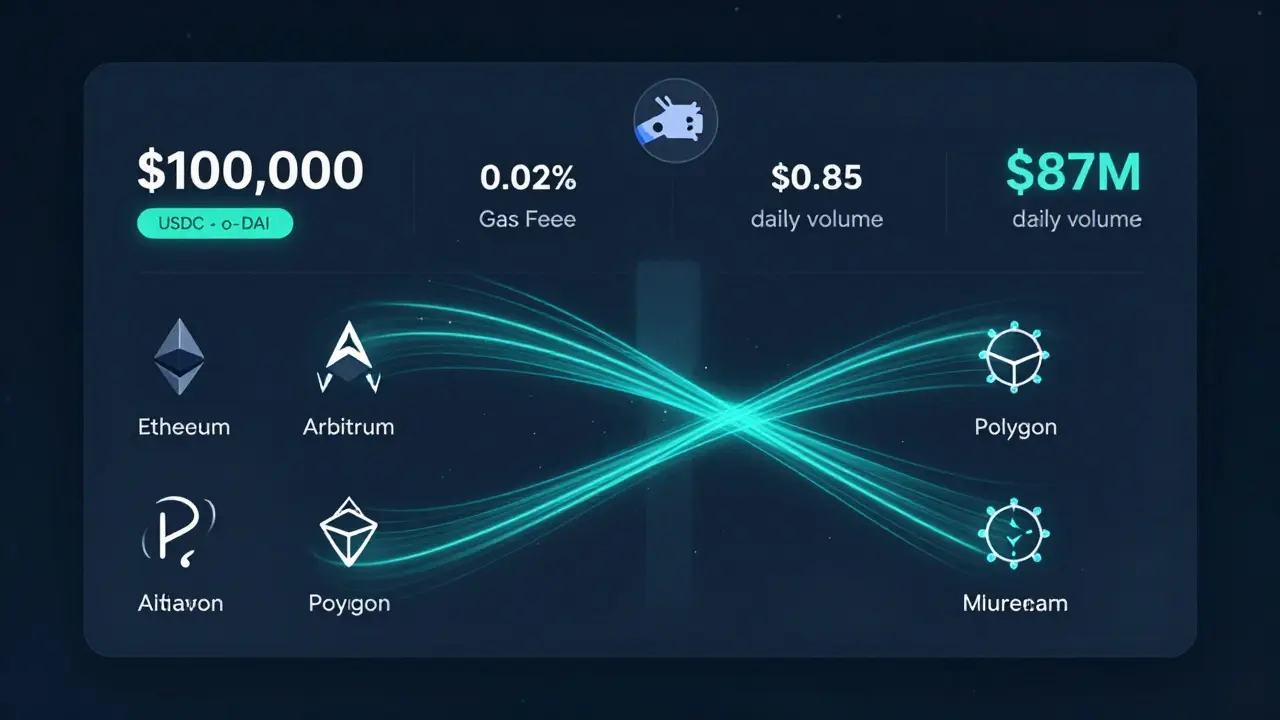

Related to xSigma are DeFi yield aggregators, platforms that automatically shift funds between protocols to maximize returns, like Yearn Finance or Beefy Finance. But xSigma stands out by focusing on cross-chain efficiency—meaning you can earn yield on assets from Ethereum, Polygon, or Arbitrum without locking them into one network. It also ties into crypto exchange liquidity, the depth of trading volume that keeps prices stable during large trades. Without enough liquidity, even the smartest yield strategy can fail when you try to exit. That’s why xSigma’s design matters: it doesn’t just chase high APYs—it tries to keep your capital safe while doing it.

What you won’t find in most reviews is the real trade-off: lower fees and smoother swaps come with less transparency. xSigma doesn’t publish full smart contract audits like some bigger names, and its tokenomics are intentionally opaque. If you’re someone who checks every line of code before depositing, you’ll want to dig deeper. But if you’re a hands-off yield farmer who trusts well-known interfaces and just wants to see your balance grow, xSigma might be worth a small test. The community is small but active, and the team has quietly improved the UI over the last six months—something many similar projects never bother with.

Below, you’ll find real user experiences, breakdowns of its token mechanics, and comparisons with other platforms that do similar things. Some posts expose hidden risks. Others show how people turned $500 into $650 in 30 days using xSigma’s auto-compounding feature. There’s no hype here—just what’s working, what’s broken, and who should stay away.