xSigma DEX: What It Is, How It Works, and What You Need to Know

When you trade crypto without a middleman, you’re using a xSigma DEX, a decentralized exchange designed for direct peer-to-peer token swaps with minimal slippage and low fees. It’s not a platform you sign up for—it’s smart contract code running on-chain, letting you trade tokens without handing over control of your wallet. Unlike centralized exchanges, there’s no KYC, no deposit hold, and no company that can freeze your funds. You interact directly with the protocol using your wallet—MetaMask, Phantom, or whatever you use.

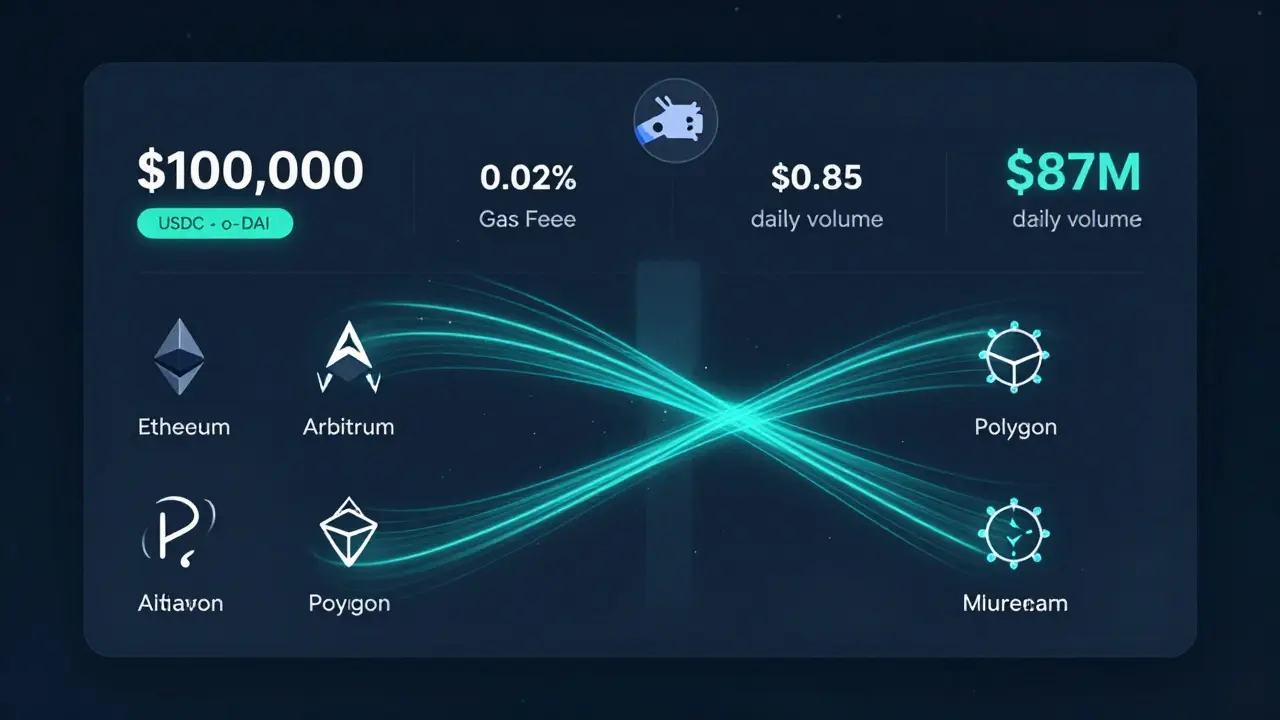

What makes xSigma DEX stand out? It’s built for liquidity efficiency, a system that concentrates trading volume into tighter price ranges to reduce slippage. This is different from older DEX models like Uniswap V2, where liquidity is spread thin across a wide price range. xSigma uses concentrated liquidity, a technique borrowed from Uniswap V3 that lets liquidity providers earn more fees by focusing their capital where trades actually happen. The result? Better prices for traders and higher returns for those who supply liquidity. It’s not just about speed—it’s about making every dollar of liquidity work harder. That’s why users who trade stablecoins, wrapped assets, or low-volume tokens often turn to xSigma instead of bigger names. It’s not the most popular DEX, but it’s one of the most efficient for specific use cases.

But here’s the catch: xSigma DEX doesn’t exist in a vacuum. It’s often used alongside DEX aggregators, tools like 1inch or Matcha that scan multiple decentralized exchanges to find the best possible price. If you’re swapping a rare token, xSigma might be one of the few places with enough depth to fill your order. But if you’re trading ETH for USDC, you might get a better rate elsewhere. That’s why smart traders check multiple sources before clicking confirm. And while xSigma doesn’t have a native token (unlike SushiSwap or Curve), its value comes from how well it executes trades—no marketing, no airdrops, just clean code.

There’s no dashboard to log into. No customer support line. You’re on your own. That’s the trade-off for true decentralization. If you’re new to DeFi, this can feel intimidating. But if you’ve used a wallet before, you already know how to interact with xSigma DEX. Just connect, approve the token, set your slippage tolerance, and swap. No middlemen. No delays. No surprises—if you’ve done your homework.

Below, you’ll find real reviews, breakdowns, and comparisons of platforms like xSigma DEX—what works, what doesn’t, and who should avoid them. Some posts expose fake airdrops. Others reveal why a DEX with great tech still fails because of poor liquidity. One dives into how a single exploit wiped out $56M in a similar protocol. Another explains why some traders stick with xSigma even when it’s not the flashiest option. These aren’t guesses. They’re facts from people who’ve used these tools—and lived through the mistakes.