Stablecoin Exchange: Where to Trade USDT, USDC, and Other Digital Dollars Safely

When you trade on a stablecoin exchange, a platform built specifically for trading digital currencies pegged to the US dollar or other stable assets. Also known as fiat-backed crypto trading platforms, it lets you move between Bitcoin, Ethereum, and dollar-pegged tokens like USDT or USDC without touching volatile markets. This isn’t just about avoiding price swings—it’s about keeping your capital liquid, ready to jump into new opportunities when they appear.

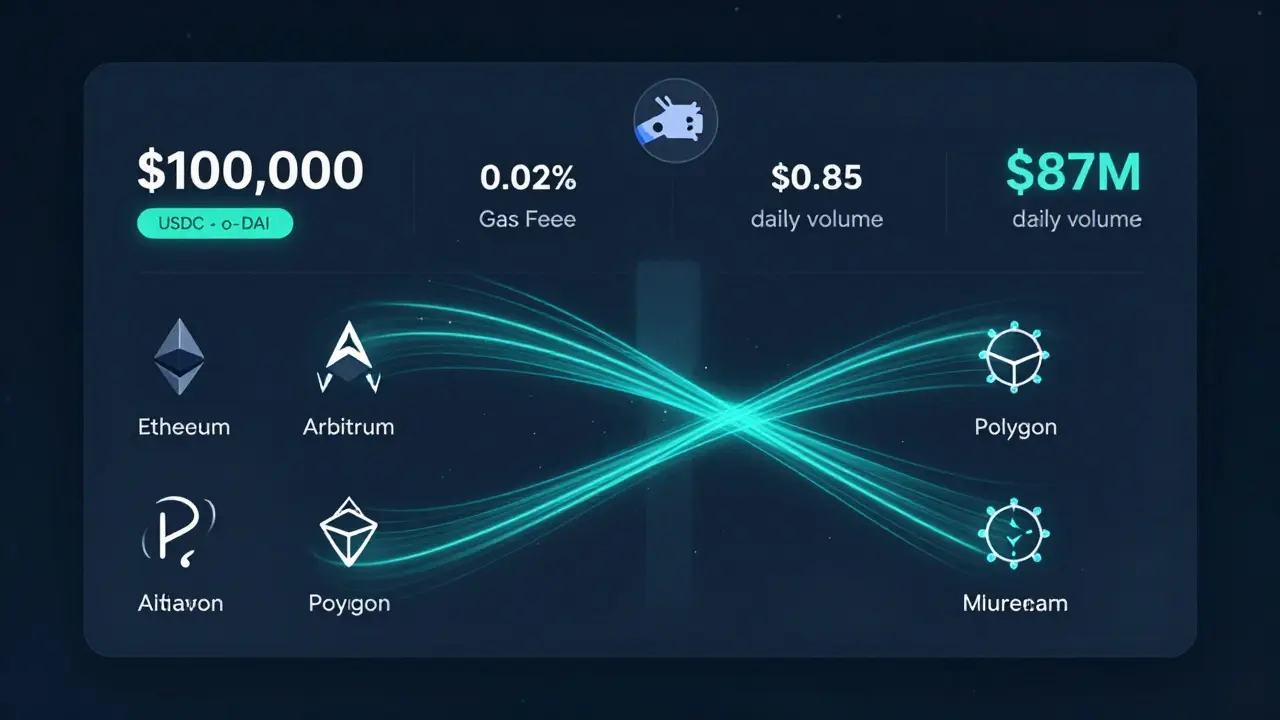

Not all exchanges handle stablecoins the same way. Some charge high fees for deposits or withdrawals, others have fake liquidity that disappears when you try to trade. You need real volume, not just a pretty dashboard. The best stablecoin exchanges offer fast swaps between tokens like USDT, USDC, DAI, and even newer ones like FRAX—without needing bridges or complex steps. Some, like Hermes Protocol, even let you trade stable and volatile assets across chains without moving funds. Others, like Echobit or SyncSwap, focus on speed and low gas costs, but often skimp on support or have hidden risks.

Regulation is changing the game too. The new GENIUS Act, set to launch in 2027, will force issuers to prove they hold 1:1 reserves and ban unlicensed players. That means some stablecoins you use today might vanish—or become harder to trade. Meanwhile, exchanges in places like Iran and Russia face government crackdowns that freeze accounts, limit withdrawal amounts, or shut down entire platforms overnight. You can’t just pick the cheapest exchange—you need one that’s still standing next year.

And don’t get fooled by fake airdrops or sketchy DEXs promising free tokens. KCCSwap’s "airdrop"? Not real. NAMA Finance’s token drop? Confused with another project. These aren’t mistakes—they’re traps. The stablecoin exchange you choose should be transparent, audited, and have a track record. You don’t need hype. You need reliability.

Below, you’ll find real reviews of exchanges that actually work in 2025—some with low fees, others with strong security, and a few that let you trade across blockchains without losing half your balance to gas. You’ll also see which platforms are dead, which ones are hiding risks, and how to spot a scam before you deposit a dime. This isn’t theory. It’s what people are using—and avoiding—right now.