Polkadot DeFi: How Substrate Chains Power Decentralized Finance

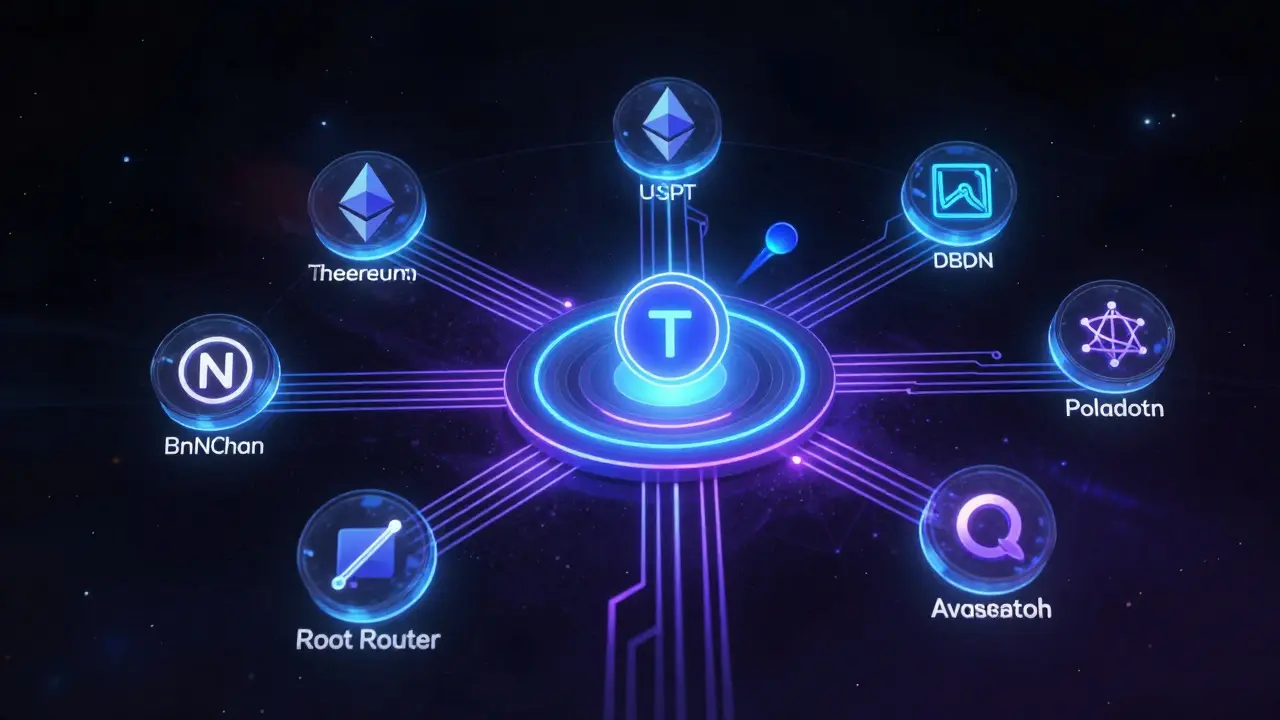

When you hear Polkadot DeFi, a multi-chain ecosystem that connects independent blockchains to share security and data. Also known as Polkadot ecosystem, it enables decentralized finance apps to run across different networks without relying on a single chain. Unlike Ethereum, where all DeFi apps compete for space and high fees, Polkadot lets each project run on its own parachain, a dedicated blockchain that connects to the Polkadot relay chain—giving them speed, custom rules, and room to grow. This means a DeFi protocol can be built for high-frequency trading, another for privacy, and another for stablecoins—all without slowing each other down.

Behind Polkadot DeFi is Substrate, a modular framework developers use to build custom blockchains that plug into Polkadot. It’s not a coin or a wallet—it’s the toolkit. Think of it like LEGO bricks: you pick the pieces you need (consensus, token economy, governance) and snap them together. That’s why projects like Acala, Moonbeam, and Kusama can offer different flavors of DeFi while still being part of the same secure network. The relay chain handles security and cross-chain messaging, so developers don’t have to build their own from scratch. This cuts development time, reduces risk, and lets innovation move faster.

What makes Polkadot DeFi different isn’t just the tech—it’s the way it solves real problems. If one parachain gets hacked, the rest stay safe. If a DeFi app needs more throughput, it doesn’t beg for gas fees—it just upgrades its own chain. And because parachains can talk to each other, you can swap tokens between chains without bridges that leak funds. This isn’t theory. It’s what’s already happening. You’ll find posts here that break down real DeFi tools built on Polkadot, how staking works across parachains, and why some projects thrive while others vanish. Some are serious finance platforms. Others are experimental. All of them live on this shared foundation. Below, you’ll see real examples: what’s working, what’s broken, and what’s next for users who want more control over their money without the chaos of single-chain systems.