Omnichain Crypto: What It Is and Why It’s Changing How You Trade Tokens

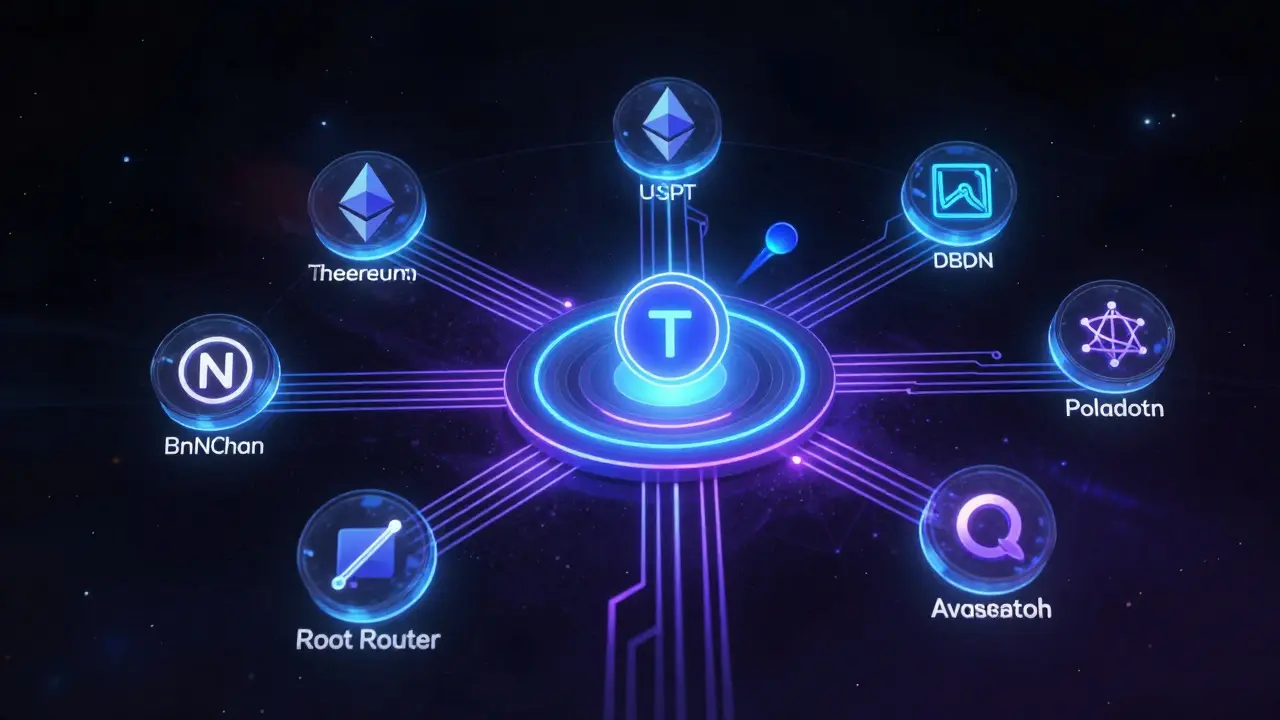

When you hear omnichain crypto, a system that lets tokens, data, and actions flow freely between different blockchains without needing middlemen. Also known as cross-chain interoperability, it’s what happens when your Ethereum-based token can swap directly for a Solana-based NFT — no wrapping, no bridges, no waiting. This isn’t science fiction. It’s the new baseline for how DeFi, NFTs, and wallets are built today.

Before omnichain, you needed blockchain bridges, third-party tools that lock your asset on one chain and mint a fake version on another. Also known as cross-chain relays, they were slow, expensive, and often hacked — over $2 billion lost since 2020. Now, native omnichain protocols like LayerZero, Chainlink CCIP, and Axelar handle this at the protocol level. You don’t need to trust a bridge. You just send your asset, and it arrives on the other chain — same speed, same security, same control.

This shift changes everything for users. Want to stake BNT on Bancor but hold your ETH on Arbitrum? Omnichain lets you do it without moving your funds. Trading on Echobit but want to claim a KCC airdrop? No more switching wallets. The rise of multi-chain wallets, wallets that natively support dozens of chains without needing separate keys or addresses. Also known as unified crypto wallets, they’re now the standard for serious traders. You manage one wallet, and it talks to every chain. No more juggling 10 different apps.

But here’s the catch: not all omnichain projects are equal. Some are just rebranded bridges. Others, like SyncSwap on Scroll or Firebird Finance, are building real cross-chain routing with low slippage and real rewards. And while you’ll find posts here about fake airdrops like KCCSwap or NAMA, you’ll also see real tools — like xSigma for stablecoin swaps across chains or ChainAware.ai detecting fraud on multi-chain transactions. This collection isn’t about hype. It’s about what actually works when you’re trading, staking, or securing assets across chains in 2025.

Below, you’ll find honest reviews, deep dives, and sharp warnings about the tools, tokens, and platforms shaping this new era. Whether you’re trying to avoid scams, find the lowest fees, or just understand how your crypto moves between networks — this is your guide.