Multi-chain DeFi: Cross-Chain Swaps, DEXs, and How They Really Work

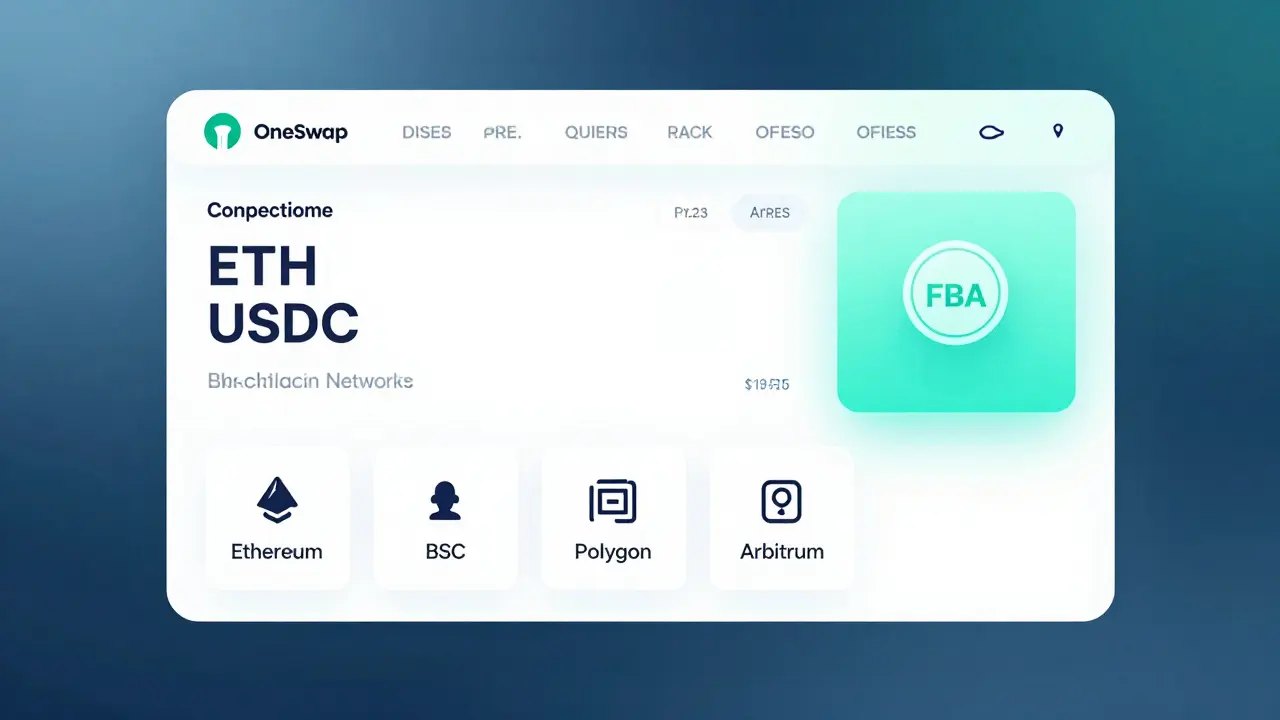

When you trade crypto across different blockchains without switching wallets or waiting hours for bridges, you’re using multi-chain DeFi, a system that connects multiple blockchains so assets and liquidity can move natively between them. It’s not just a buzzword—it’s what lets you swap ETH for SOL on a single interface, or stake on Polygon while earning yields on Arbitrum, all without wrapping tokens or paying bridge fees. This isn’t theoretical. Real platforms like Hermes Protocol, an omnichain decentralized exchange that routes trades across chains without bridges and SyncSwap, a DEX built on Scroll that tries to unify stablecoin swaps across L2s are already doing it. But not all of them work well. Some have thin liquidity. Others charge hidden costs. And a few are just rebranded bridges with a new name.

What makes multi-chain DeFi different from old-school cross-chain tools? It skips the middleman. Traditional bridges lock your ETH on Ethereum and mint wrapped ETH on Solana. That’s risky—you’re trusting a smart contract to hold your funds. Multi-chain DeFi, when done right, routes your trade directly using liquidity pools that exist on both chains at once. It’s like having a single ATM that pulls cash from multiple banks without transferring money between them. That’s why platforms like xSigma, a DEX focused on ultra-low-slippage stablecoin swaps across chains are gaining traction. They don’t try to solve everything. They focus on one thing: moving USDC, DAI, or USDT fast and cheap between chains.

But here’s the catch: multi-chain DeFi isn’t magic. It needs deep liquidity on every chain it touches. That’s why most of the successful ones—like Hermes Protocol—are used mostly by traders who already hold assets on Polkadot, Scroll, or Polygon. If you’re trying to swap from a lesser-known chain, you’ll likely hit dead ends. And not every platform that says "omnichain" actually is. Some just list more chains on their website. Real multi-chain DeFi means seamless, native routing—not just a dropdown menu with 15 blockchains.

You’ll find posts here that break down exactly how these platforms work, where they fall short, and who should use them. Some are tools you can start using today. Others are cautionary tales—like SyncSwap, where buying the token is broken and support is gone. There’s no fluff. Just real user experiences, fee comparisons, and what actually moves on-chain. Whether you’re swapping stablecoins, staking across chains, or just trying to avoid bridge hacks, this collection gives you the facts you need to move safely in a multi-chain world.