Best Stablecoin Swap: How to Trade Stablecoins with Low Fees and High Safety

When you swap stablecoin, a digital currency pegged to a stable asset like the U.S. dollar. Also known as payment stablecoin, it lets you move in and out of crypto without riding the rollercoaster of Bitcoin or Ethereum prices. The goal isn’t to get rich overnight—it’s to preserve value while you wait for the next big move. That’s why the best stablecoin swap isn’t about the flashiest interface or the highest APY. It’s about speed, low fees, and trust. You don’t want to lose 0.5% on a $1,000 swap because the platform uses a broken liquidity pool or charges hidden fees. You want to know exactly where your money goes and how much you’ll get back.

Not all stablecoins are the same. USDT, Tether’s token, the most traded stablecoin with billions in daily volume. Also known as Tether, it’s widely supported but has faced transparency questions. USDC, Circle’s dollar-backed token, fully reserved and regularly audited. Also known as USD Coin, it’s the go-to for regulated platforms and institutional users. And DAI, a decentralized stablecoin backed by crypto collateral, not cash. Also known as MakerDAO stablecoin, it’s the only one that doesn’t rely on a company’s balance sheet. Each has different risks and strengths. A good swap tool should handle all three without forcing you to jump through hoops.

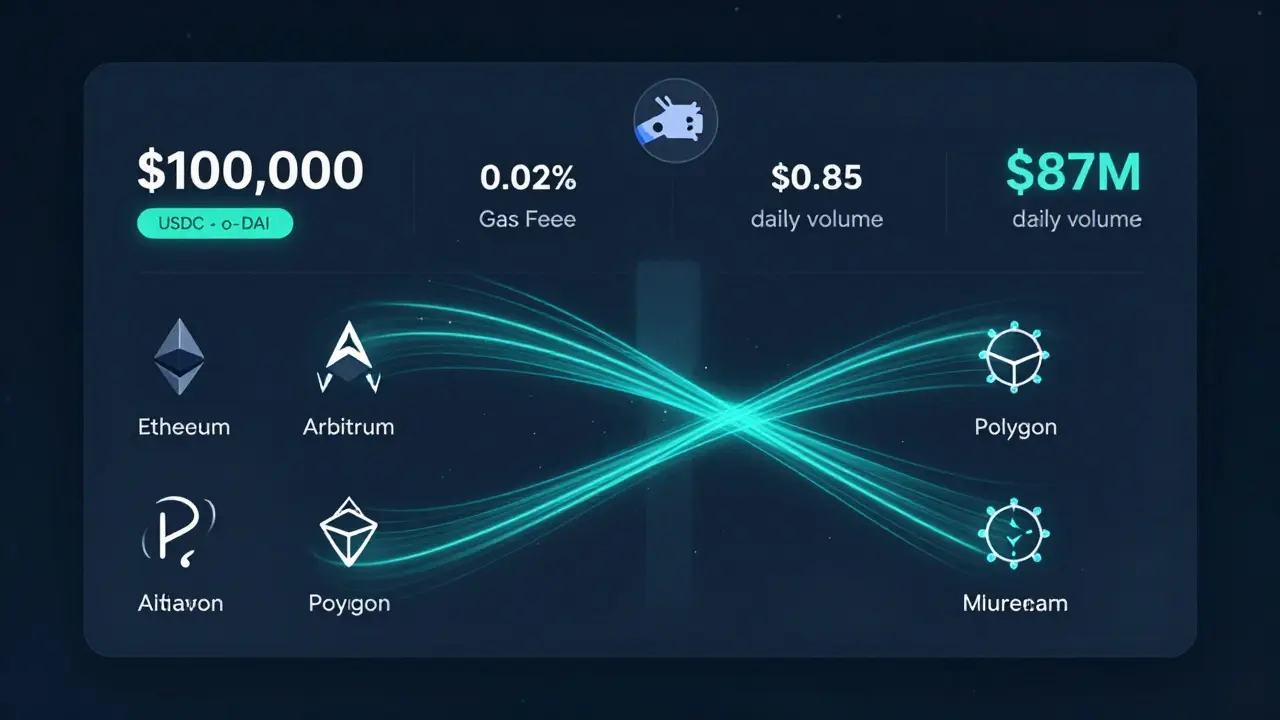

Where you swap matters just as much as what you swap. Some platforms act like middlemen, routing your trade through multiple pools and charging fees at every step. Others use direct, on-chain liquidity that cuts out the noise. You’ll see tools like Hermes Protocol, an omnichain DEX that swaps stablecoins across chains without bridges. Also known as cross-chain DEX, it’s built for users who move between Ethereum, Polygon, and Solana. Then there are aggregators like Firebird Finance, a multi-chain platform that finds the best rates across 140+ exchanges. Also known as DEX aggregator, it’s great for squeezing out pennies on large swaps. But even these can fail if liquidity is thin or the token has no real value—like the HOPE token some platforms push as a reward. Don’t trade your stability for a gamble.

Regulation also plays a role. The new GENIUS Act, the first federal U.S. law requiring stablecoin issuers to hold 1:1 reserves and get licensed. Also known as federal stablecoin framework, it’s set to roll out in 2027. That means platforms that don’t comply will vanish. The ones that survive will be safer. But until then, you’re on your own. That’s why you need to know who’s behind the swap, how reserves are verified, and whether the platform has ever been hacked. A platform that’s been around five years without a breach? That’s worth more than a 0.01% lower fee.

What you’ll find below isn’t a list of top platforms. It’s a collection of real reviews, deep dives, and warnings from people who’ve tried them all. Some platforms promise low fees but leave you stuck with unusable tokens. Others have great security but no support when things go wrong. You’ll see which ones actually work for daily swaps, which ones are scams in disguise, and which ones you should avoid even if they look tempting. This isn’t theory. It’s what happened when real people tried to move their money—safely, quickly, and without losing a cent.